How Online Education is Shaping the Next Generation

The financial world is undergoing a seismic shift. From the rise of AI in algorithmic trading to the growing imperative of ESG (Environmental, Social, and Governance) investing, the demands on finance professionals are evolving at an unprecedented pace. Traditional education, while foundational, often struggles to keep up with these rapid industry transformations. This is where online education steps in, not just as an alternative, but as a critical catalyst in forging the finance experts of tomorrow.

By 2026, the landscape of financial expertise will be inextricably linked to digital learning. Aspiring and current finance professionals are increasingly turning to online platforms to gain relevant, up-to-date skills and navigate complex market dynamics. The flexibility and accessibility offered by online learning environments, coupled with the ability to integrate real-time market data, are preparing a generation of experts who are not just knowledgeable, but adaptable. For many, managing the rigorous demands of advanced financial concepts often necessitates seeking dedicated online class help to ensure conceptual clarity and academic success.

The Unstoppable Rise of Digital Learning in Finance

The move towards online education isn’t just a trend; it’s a fundamental restructuring of how knowledge is acquired. Data consistently underscores this paradigm shift:

- Global Adoption: Nearly 49% of students worldwide have engaged in at least one online course.

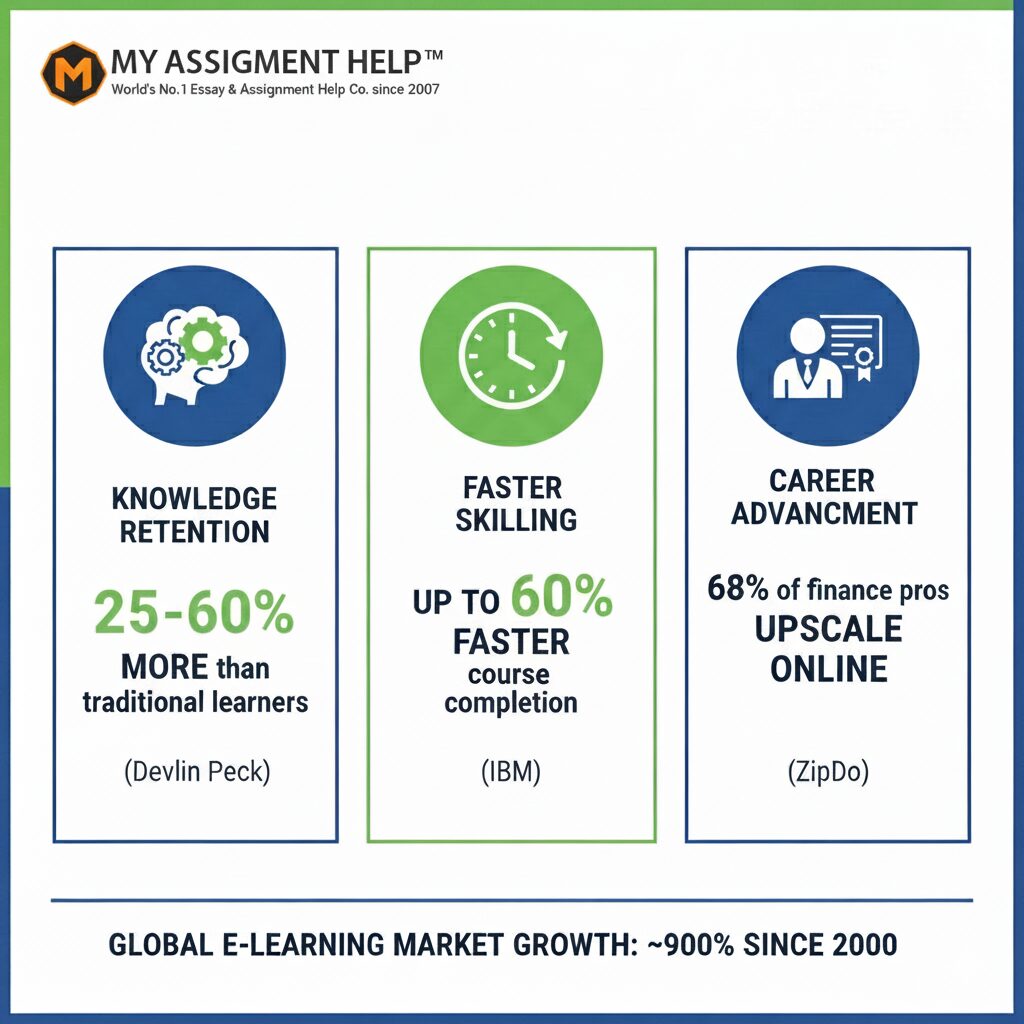

- Enhanced Retention: Research suggests online learners retain 25% to 60% more information than those in traditional classrooms.

- Efficiency: According to an IBM Digital Learning Report, online programs allow learners to complete courses up to 60% faster.

Traditional vs. Online Finance Learning: 2026 Comparison

To further clarify the advantages, let’s look at a comparative table that highlights why modern experts are choosing digital paths.

| Feature | Traditional Classroom Learning | Online Finance Education |

| Pace | Fixed semester schedules | Self-paced & modular |

| Content Freshness | 2–5 year textbook cycles | Monthly/Real-time updates |

| Practical Tooling | Limited lab access | Integrated Python/SQL labs |

| Networking | Localized/Regional | Global peer & alumni networks |

| Cost Efficiency | High (Tuition + Housing) | Scalable & micro-credentialing |

Why Online Education is the Future of Finance

Finance education today extends far beyond basic accounting. Professionals must grasp sophisticated concepts like quantitative finance and blockchain technology. Online platforms are uniquely positioned to address these advanced needs due to their inherent agility.

- Rapid Content Updates: Unlike static textbooks, online courses update in real-time to reflect the latest market trends.

- Integration of Real-World Tools: Learners engage with actual trading simulators and data analytics tools within their curriculum.

- Global Perspectives: Online environments connect students with instructors from top-tier global institutions without geographic barriers.

How Online Education Builds Future Financial Experts

The journey to becoming a top-tier financial expert in 2026 requires a blend of theory and practical execution.

Industry Impact: Closing the Global Skills Gap

TheWorld Economic Forum has emphasized that digital education is vital for closing skills gaps in data-intensive sectors like economics. By removing barriers, online learning fosters a more inclusive talent pipeline. Furthermore, 72% of financial institutions now plan to increase investment in digital training to remain competitive.

Preparing for the Future of Finance

The financial expert of 2026 must be a lifelong learner. Whether you are browsing for stock market forecasts or studying algorithmic trading, digital platforms provide the micro-credentials needed to stay relevant.

Conclusion

Online education is no longer a “second choice”—it is the engine driving the next generation of finance. By combining accessibility with real-world application, it prepares experts who are ready for the 2026 market and beyond.

People Also Ask

Q1. Is an online finance degree worth it in 2026?

Absolutely. In 2026, employers value skills over physical location. An online degree from an accredited body demonstrates high levels of digital literacy and self-discipline, which are essential in a remote-first finance world.

Q2. Will online education help me rank in a top finance firm?

Yes, especially if you focus on micro-credentials. Many firms now look for specialized certifications in AI for Finance or Fintech, which are often best taught through agile online platforms.

Q3. How does online education improve financial literacy?

It bridges the gap by offering modular, low-cost courses in budgeting and risk management. Reports from the Financial Times suggest that interactive simulations found in online courses significantly increase confidence in real-world decision-making.

Author Note

Written by Ashley, a senior content writer at MyAssignmentHelp, specializing in finance, education, and data-driven digital learning trends, with extensive experience creating authoritative content aligned with global industry research.