NCL Research share price target: 2024, 2025, 2026, 2028 and 2030

NCL Research & Financial Services Limited is a non-banking financial firm catering to micro, small, and medium enterprises. The company provides secured and unsecured loans based on the risk profiles of its customers. NCL Research share price target.

While the company experienced significant growth about two years ago, it is currently facing a decline. Its stock is trading at Rs 0.40, reflecting a 47.3 percent decrease over the past year.

However, the company’s reported revenue for March 2023 is Rs 1.01 crore, marking a 71.01 percent year-on-year increase. The net profit is Rs 0.42 crore, with a net profit margin of 41.58 percent.

Experts anticipate a bullish trend for this stock shortly, suggesting potential investor benefits. Below are the projected target prices for NCL Research for the years 2024, 2025, 2026, 2028, and 2030.

NCL Research: Overview

The company was established on 04 February 1985 in India under the brand name NCL Research & Financial Services Limited. The company is involved in the trading of Textile products besides investing activities in Shares and Securities.

The company invests in various companies, both listed and unlisted, as equity. Also, invests in companies across a variety of markets and stages.

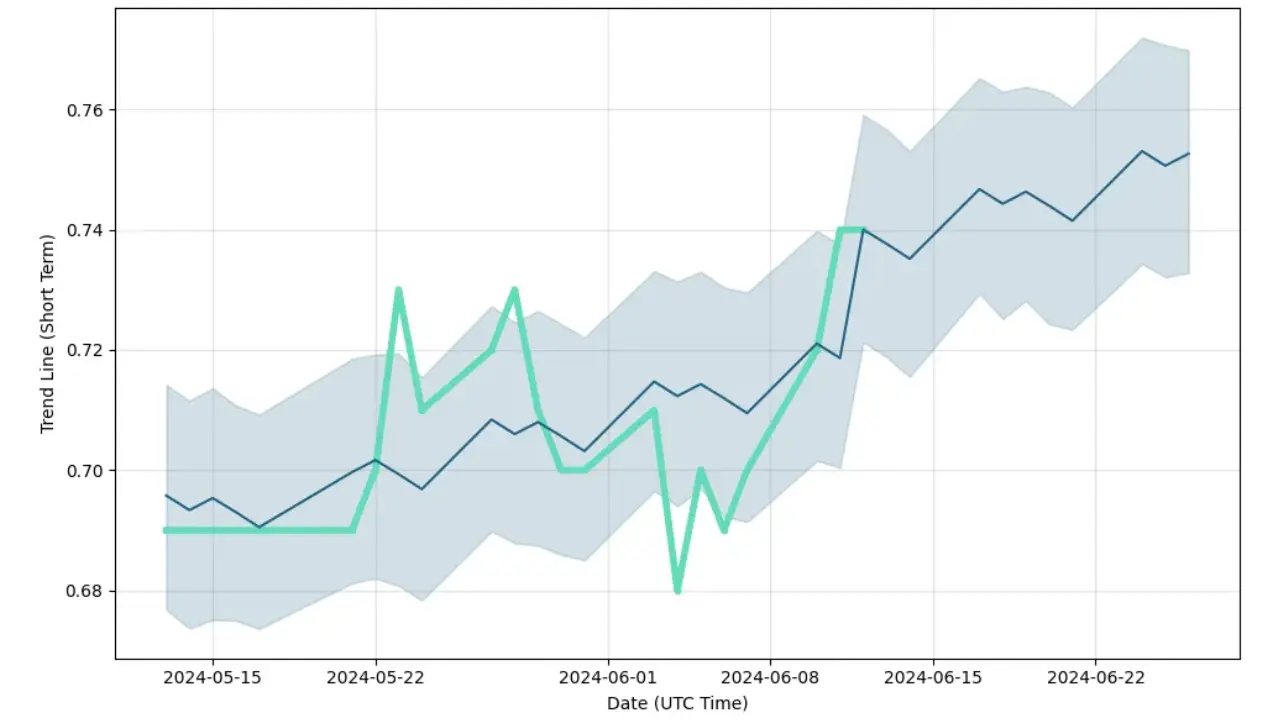

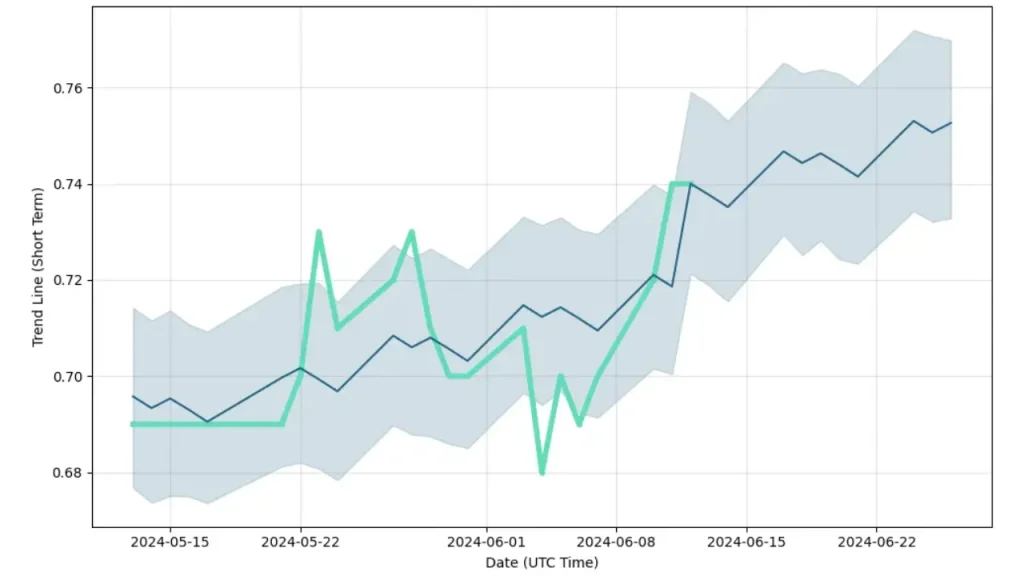

NCL Research share price target for 2024 to 2030

The target price is based on our research and technical analysis, which is an estimated price and not an actual price:

| Year | Low | High |

|---|---|---|

| 2023 | 0.65 | 0.90 |

| 2024 | 1.10 | 1.75 |

| 2025 | 2.05 | 3.75 |

| 2026 | 3.95 | 5.15 |

| 2028 | 8.35 | 10.15 |

| 2030 | 15.50 | 20.20 |

NCL Research: Fundamentals

2024

The share price of NCL Research is expected to keep rising throughout 2024. Our team projects that the share price of NCL Research could reach anywhere between Rs 1.10 and Rs 1.75 by the end of the year.

2025

The financial services sector is experiencing substantial demand, which NCL Research is capitalizing on. Although its revenue growth has been consistently increasing year over year, the company has shown a disappointing return on equity (ROE) in the past two years. Nevertheless, analysts have set a target price range of Rs 2.05 to Rs 3.75 for NCL Research shares by 2025.

2026

The net sales increased by 47.31% to reach Rs 1.02 crore in March 2023, up from Rs 0.69 crore in March 2022. However, despite this growth in sales, there has been a decline in net income. Nevertheless, NCL Research shares are projected to potentially reach between Rs 3.95 and Rs 5.15 by 2026 as their maximum target price.

2028

The company boasts effective management and a team of highly qualified professionals. Based on historical trends from October 2021, it is anticipated that the share price will follow a similar trajectory in the long term, potentially yielding favorable returns. Therefore, the projected target price range for NCL Research shares by 2028 is estimated to be between Rs 8.35 and Rs 10.35.

2030

The company has a minimal debt ratio and carries no significant liabilities. Its management demonstrates strength in overseeing financial operations and diversifying income sources effectively. NCL Research projects a potential target price range of Rs 15.50 to Rs 20.20 by 2030.

FAQs

What is the target price of NCL Research in 2025?

The target price of NCL Research in 2025 is Rs 2.05 to Rs 3.75.

Is NCL Research and Finance Services Ltd. a good stock?

NCL Research is a good stock for the long term and expects good returns. But, it is suggested to invest a smaller amount or look for a better investment option.

What is the target price of NCL Research in 2030?

The highest target price of NCL Research in 2030 is Rs 15.50 to Rs 20.20.

What does NCL research do?

NCL Research is involved in the trading of textile products besides investing in shares and securities.

Disclaimer: The target prices listed on our website (bankshala.com) are provided solely for informational purposes. None of the content on our website constitutes financial or legal advice. Prior to making any investment in stocks, you must conduct your research and seek guidance from a qualified financial advisor.