Patel Engineering Share Price Target 2024, 2025, 2027, 2030

In today’s blog, we aim to elucidate the fundamental concept of Patel Engineering’s anticipated share price targets for 2024, 2025, 2027, and 2030. Our analysis incorporates extensive research and insights from industry experts, focusing on the company’s growth trajectory and projected share price targets.

Patel Engineering boasts a long-standing legacy as one of the oldest companies in its sector. Throughout its history, the company has consistently demonstrated robust performance and has recently expanded its operations through various strategic projects aimed at enhancing profitability. For potential investors looking to delve deeper into Patel Engineering’s future prospects, this blog offers valuable insights into its anticipated share price targets for the years ahead. Let’s delve into Patel Engineering’s projected share price targets for 2024, 2025, 2027, and 2030.

What is Patel Engineering Company

Patel Engineering is a prominent player in India’s civil engineering and infrastructure services sector. Established in April 1949, the company operates nationwide, specializing in various infrastructure projects such as highways, railways, bridges, dams, hydroelectric projects, and transportation networks.

Noteworthy clients like NTPC and NHPC are among the company’s prominent customers. Here’s an overview of Patel Engineering’s projected share price targets for the years 2024, 2025, 2027, and 2030.

Overview About Patel Engineering Company

Patel Engineering Company stands as a venerable presence in the construction industry. Over the past three years, the company has consistently grown at a rate of 15%. However, this year’s profits have surged by approximately 35%, marking a highly promising development for the company. The construction sector continues to benefit from substantial new orders driven by ongoing urban and rural development, further fueling its expansion. At the helm of Patel Engineering Company is Mr. Rupen Patel, serving as both chairman and managing director.

PE Ratio

The PE Ratio (Price Of Earning Ratio) of Patel Engineering is 16.975 which indicates a good sign in the investment market it means an investor wants to pay 17.23 in this share for earning every single rupee.

Current Ratio

Patel Engineering has a current ratio of 1.40. The current Ratio means the amount of liabilities the company can pay in the ratio of its assets.

Return Of Assets (ROA)

Return on Assets can evaluate how much return money a company can earn from its investment assets. Patel Engineering has a ROA of 1.99%.

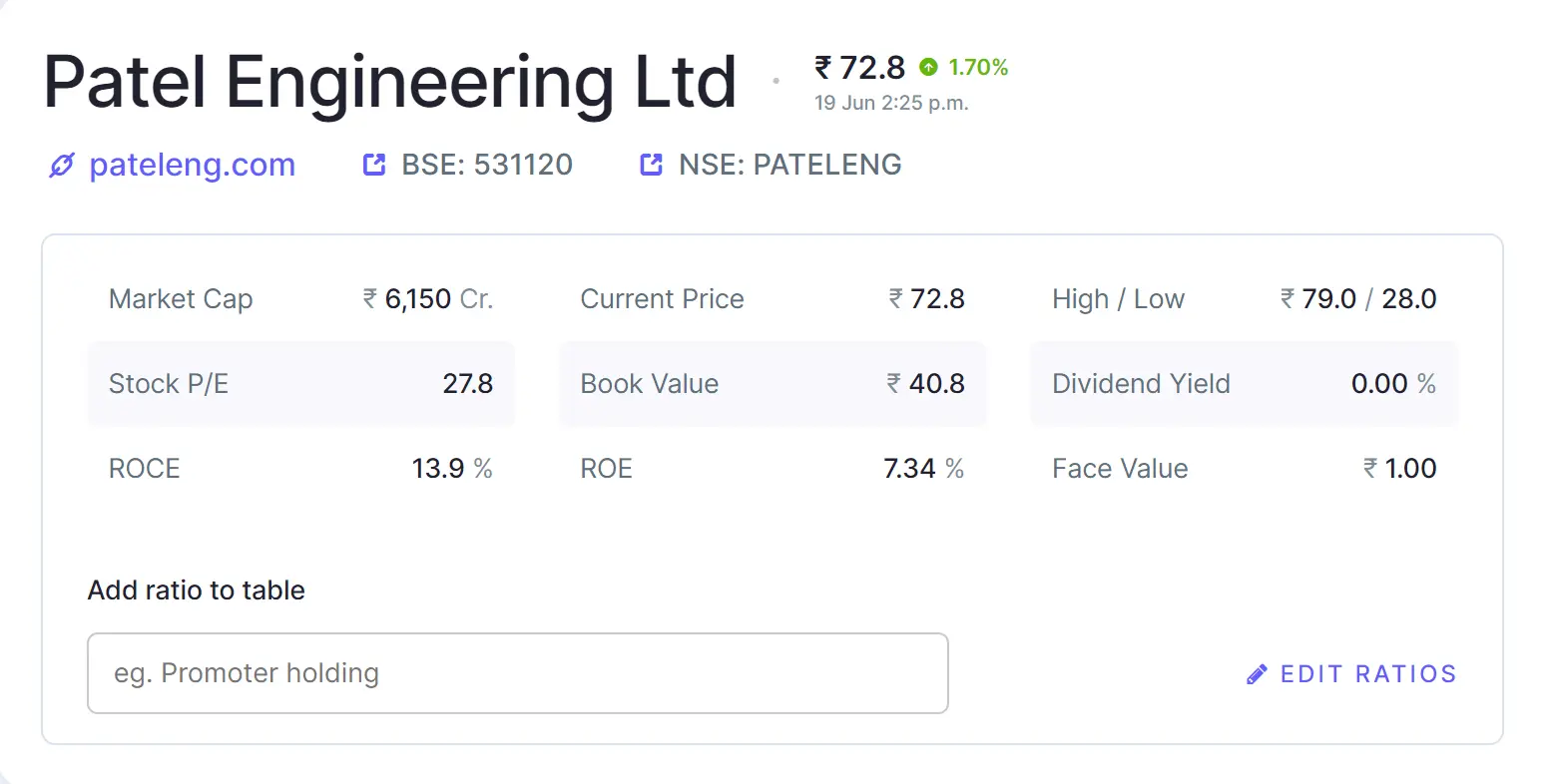

Fundamental Analysis Of Patel Engineering Company

| Company Name | Patel Engineering Ltd |

| Establish | In 1949 |

| Face Value | ₹1 |

| Book Value | ₹42.23 |

| 52 Week High | ₹80 |

| 52 Week Low | ₹23.80 |

| DIV. YIELD | 0% |

History Of Patel Engineering Share Price Target From 2024 to 2030

Patel Engineering’s future prospects appear promising for investors, buoyed by anticipated sales growth that could significantly enhance the company’s financial health. Founded in 1949, Patel Engineering has shown consistent growth from 2024 to 2050, bolstered by increasing sales and expanding shareholder base. In March 2023, the company achieved a notable net profit of 155.562. Moreover, Patel Engineering has successfully expanded its operations nationwide. Over the past three years, the company maintained a steady sales growth of 13%, which surged to 30% in the last fiscal year.

As Patel Engineering is a construction sector and every country has done much new constructions for making new buildings, new roads, and new offices, the pressure of the work also increases.

Using new technology the Patel Engineering company increases the quality of products. If we talk about the shares, the growth of shares also increases with the company’s growth. Let’s look at Patel Engineering Share Price Target for 2024, 2025, 2027, 2030.

Patel Engineering Share Price Target 2024

The profit growth of the company also increased in the last 5 years profit growth was 22.23% which increased to 62.23% in the last 3 year’s and last year’s it increased to 185.22%. The net profit amount was ₹56.23 Crore in March 2022 which became ₹156.79 Crore in March 2023. The operating profit amount was ₹136.47 Crore in March 2022 which became ₹145.75 Crore in March 2023.

| Year | Patel Engineering Share Price Target 2024 |

| First Price Target | 60 |

| Second Price Target | 90 |

The company has a total power generation capacity is over 8000 MW and a total tunnel capacity of 180 km. Some of the projects of the company are the Earth Fill Dam, Powerhouse & Tail Race Channel Switchyard. Another one is the Ghatghar RCC dams. The first Price Target of Patel Engineering Share Price Target 2024 is ₹60 and the Second Price Target is ₹90.

Patel Engineering Share Price Target 2025

The net sales amount was ₹3,025.69 Crore in March 2022 which became ₹3,585.56 Crore in March 2023. The ROCE percentage of the company was 10.02% in the last 5 years which became 10.85% in the last 3 years and in the last 1 year it became 14.02%.

| Year | Patel Engineering Share Price Target 2025 |

| First Price Target | 95 |

| Second Price Target | 140 |

The specialist reported that Patel Engineering’s stock returns are exceptionally strong. The company has also endeavored to augment its investment in assets, recognizing their potential for generating returns. According to the research findings from the previous fiscal year (ending March 2023), capital accounted for 76.35% of the total, yielding a profit of 197.30%. Looking ahead to Patel Engineering’s projected share price targets for 2025, the initial target stands at ₹95, with a subsequent target set at ₹140.

Patel Engineering Share Price Target 2027

Patel Engineering Company is actively involved in constructing underground powerhouses, including significant projects like Rampur H.E., which spans 15 kilometers and generates 415 MW of power. Another notable project is the Srisailam powerhouse, boasting a capacity of 900 MW. Additionally, the company has successfully delivered numerous projects in the Real Estate Sector.

| Year | Patel Engineering Share Price Target 2027 |

| First Price Target | 250 |

| Second Price Target | 300 |

Patel Engineering Share has a good promoter holding capacity. In September 2022 promoter holding capacity was 43.458%, which is a good significant for the spread out of the share and growth of the company. The first price target of Patel Engineering Share Price Target 2027 is ₹250 and the Second Price Target is ₹300.

Patel Engineering Share Price Target 2030

Patel Engineering Company also spread its business in Arunachal Pradesh where the Gongri Hydroelectric project is underway with a capacity of 144 MW. The Tax amount was 40% in March 2022 which became 24% in March 2023.

| Year | Patel Engineering Share Price Target 2030 |

| First Price Target | 400 |

| Second Price Target | 450 |

By 2030, Patel Engineering aims to achieve significant milestones in its share price, driven by robust net sales growth. Over the past three years, the company has seen an approximate 15% increase in net sales, reflecting its strong position in the construction sector and its potential for rapid expansion. The projected share price targets for 2030 are ₹395 and ₹420, respectively.

Investor types and ratio Of Patel Engineering Share

Mainly there are four types of Investors in Patel Engineering Share.

Public Holding

Public investors and individuals who participate in the stock market aim to generate future profits by investing in both large and small companies. Patel Engineering’s public ownership stands at 47.95%.

Promoter Holding

Promoter Holding means how much capital is invested by companies Promoters (owners of the capital through overall Capital). For Patel Engineering promoter holding capacity is 39.56%.

FII (Foreign Institutional Investors)

Foreign Institutional Investors are those big companies that invest in different countries Company. For Patel Engineering Share FII is 3.38%.

DII (Domestic Institutional Investors)

Domestic Institutional Investors (like Insurance, companies mutual funds) who invest in their own country. For Patel Engineering DII is 9.10%.

Should I Invest In Patel Engineering Right Now?

If anyone wants to invest in Patel Engineering Share in the Indian Share Market then he/she can get a good return from this share on a long-term basis according to specialists.

Last few years profit has been maintained below

- Jun 2022-34.506.

- December 2022-83.560.

- September 2022-15.470.

- Jun 2023-132.607.

- On a short-term basis, Patel Engineering Share may hit the lower circuit but on a long-term basis, it must return to a profitable price.

Advantages and Disadvantages of Patel Engineering

Every share has some advantages and disadvantages. Patel Engineering Share also has some advantages and disadvantages which are described below.

Advantage

- Over the past five years, Patel Engineering has experienced significant profit growth, benefiting from its status as one of the oldest firms with a robust market presence.

- The company’s strong cash flow makes it an attractive option for long-term investors seeking substantial returns.

- Specializing in infrastructure and construction services, Patel Engineering is witnessing increasing demand with each passing day.

Disadvantages

- For the last few years back Patel Engineering has hit a lower circuit but in the long-term process, it is profitable.

- The company shows a poor ROE which is 0.95% in the last 3 years.

Conclusion

Through thorough research and expert guidance, we aim to position Patel Engineering Shares favorably over the long term. Patel Engineering specializes in the construction of dams, hydroelectric projects, railways, and more, thus benefiting from increased sector demand, potentially leading to future profitability.

If you find this website useful, feel free to share it. For any questions, please leave them in the comment box, and we’ll endeavor to respond and address your queries. Thank you for visiting our site and for your continued support.

Disclaimer: We are not registered with SEBI as advisors. The financial market inherently carries risks for all participants. This website serves solely for educational and training purposes. Therefore, before making any investments, we strongly advise consulting with certified experts. Please note that we do not accept responsibility for any profits or losses incurred.