Pidilite Share Price Target: 2024, 2025, 2028, 2030, 2035

Pidilite, an Indian firm renowned for manufacturing adhesives, pigments, sealants, and various chemical products for both industrial and consumer applications, is the subject of our investment analysis. Our objective is to forecast the company’s stock performance across the years 2024, 2025, 2026, 2028, 2030, and 2035 through meticulous research. Pidilite Share Price Target.

With a robust track record of stable financial performance, Pidilite currently trades at 2647.26, marking a 19.21% increase over the past six months. The company is particularly distinguished for its Fevicol Brand of Adhesives, which enjoys substantial market demand. Additionally, Pidilite manufactures a range of products including construction and leather chemicals, pigments, art materials, and textile resins.

Based on comprehensive research and technical analysis, we have established target prices of Rs 3948.80 by 2025 and Rs 4447.79 by 2030 for Pidilite shares. While long-term growth prospects appear promising given its historical performance, short-term projections indicate moderate growth.

Pidilite Stock – Overview

Pidilite operates not only in India but also across numerous countries globally. Founded in 1959, its headquarters are located in Mumbai, India.

The company allocates substantial resources to innovation and R&D, aiming to create new products and enhance existing ones. This strategic focus enables Pidilite to maintain a competitive edge and effectively meet customer demands.

Pidilite’s product range enjoys robust popularity in the market. Below is an overview of its stock details:

| Revenue (2023) | ₹11,845 crore |

| Net Profit | ₹1,285 crore |

| Net profit margin | 10.90% |

| Face value | 1 |

Pidilite Share Price Target for 2024 to 2035

The company has shown stable performance over the past few years, and there has been no meteoric rise in the share price. Given below is the future value of Pidilite shares for the years 2024 to 2035.

| Year | Low | High |

|---|---|---|

| 2024 | ₹2,781.60 | ₹3,423.25 |

| 2025 | ₹3,452.25 | ₹3,948.80 |

| 2026 | ₹3,883.30 | ₹4,441.35 |

| 2027 | ₹4,541.35 | ₹4,839.50 |

| 2028 | ₹4,735.95 | ₹5,886.30 |

| 2029 | ₹5,839.60 | ₹6,898.35 |

| 2030 | ₹6,812.15 | ₹7,932.55 |

| 2035 | ₹11,130.20 | ₹12,600.50 |

Pidilite Share Price Target for 2024

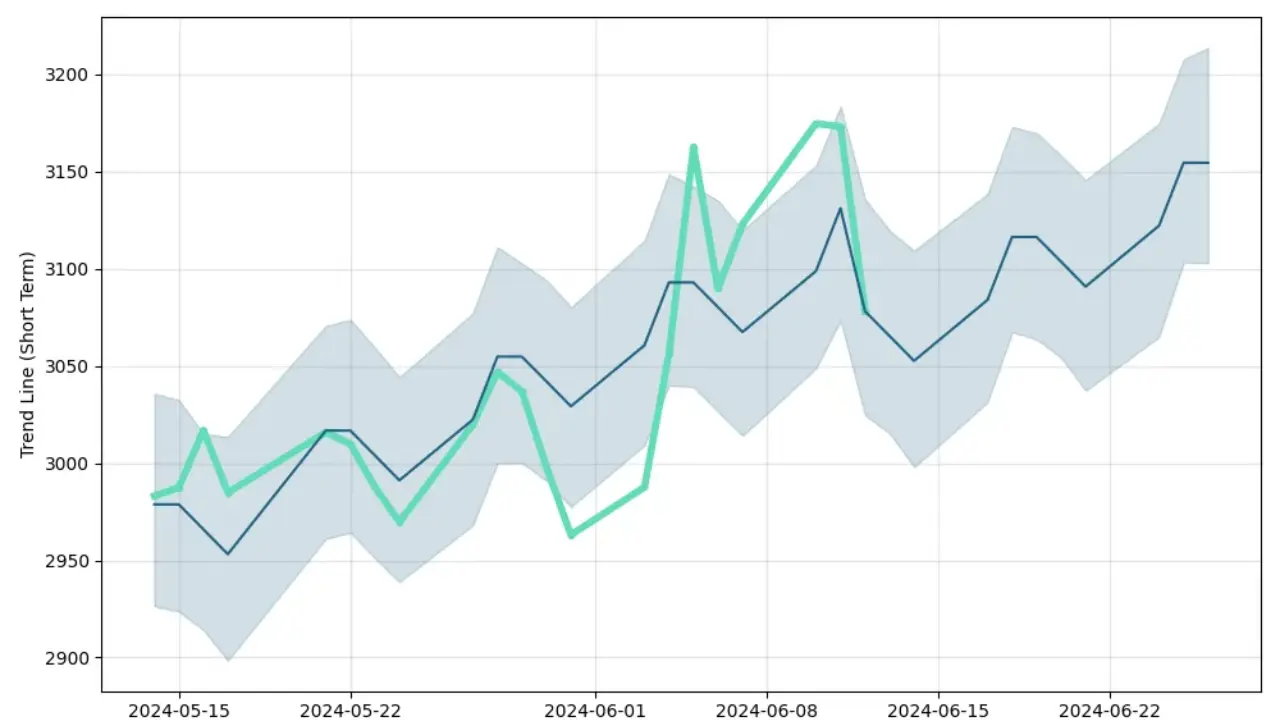

Based on our research and analysis, the Pidilite share price for the year 2024 could be Rs 3081.20 to Rs 3423.25.

| Target | Target Price |

|---|---|

| Target-I | ₹2,781.20 |

| Target-II | ₹3,423.25 |

Pidilite Share Price Target for 2025

Based on our technical analysis, Pidilite share price can reach Rs 3452.25 to Rs 3848.80 by 2025.

| Target | Target Price |

|---|---|

| Target-I | ₹3,989.25 |

| Target-II | ₹4,348.80 |

Pidilite Share Price Target for 2026

According to market trends and technical analysis, the maximum target price of Pidilite share can reach from Rs 4169.15 to Rs 4441.35.

| Target | Target Price |

|---|---|

| Target-I | ₹4,169.15 |

| Target-II | ₹4,441.35 |

Pidilite Share Price Target for 2027

According to expert opinion, the minimum price of Pidilite shares can reach Rs 4541.35, and the maximum price can reach Rs 4839.50.

| Target | Target Price |

|---|---|

| Target-I | ₹4,641.35 |

| Target-II | ₹4,839.50 |

Pidilite Share Price Target for 2028

According to our analysis, the maximum target price of Pidilite shares in 2028 is Rs 4735.95 to Rs 5886.30.

| Target | Target Price |

|---|---|

| Target-I | ₹5,426.20 |

| Target-II | ₹5,886.30 |

Pidilite Share Price Target for 2029

According to market trends, the share price may reach Rs 5839.55 to Rs 6898.35 by 2029.,

| Target | Target Price |

|---|---|

| Target-I | ₹6,237.55 |

| Target-II | ₹6,898.35 |

Pidilite Share Price Target for 2030

According to our analysis and forecast system, the minimum target price for Pidilite shares is Rs 6812.15. At the same time, the maximum target price of Pidilite can reach Rs 7932.55.

| Target | Target Price |

|---|---|

| Target-I | ₹7,354.45 |

| Target-II | ₹7,932.55 |

Pidilite Share Price Target for 2035

Based on our research, the minimum and maximum target prices for Pidilite shares are Rs 11,130.20 and 12,600.50, respectively.

Pidilite Shareholding Pattern

- Promoters: 69.54%

- Foreign Institutions: 10.08%

- Domestic Institutions: 4.31%

- Mutual Funds: 4.06%

- Others: 12.01%

Risk factors

There are several risk factors that one must be aware of before investing, which are mentioned below:

- Raw Material Cost: A variety of raw materials are used for chemicals. Therefore, fluctuations in the prices of these raw materials can negatively impact the company’s profits.

- Competition: Pidilite is not the only one in the market, there are many domestic and international companies. Therefore, there may always pricing pressure due to competition.

- Economic Status of Countries: Pidilite’s financial performance is linked to India and other countries where it operates. In such a situation, an economic recession can reduce the demand for products, as well as have negative effects.

- New Rules & Regulations: Sometimes the rules and regulations imposed by the government may go against the company.

Pidilite Business Strategy

The company maintains strong relationships with customers, provides high-quality products, and expands into new markets.

It also has many distribution networks and also provides technical support which helps in customer engagement.

FAQs

Pidilite Industries Ltd is an Indian manufacturer that sells adhesives, construction chemicals, and industrial resins. Here are some frequently asked questions regarding Pidilite share price:

What is the target price for Pidilite shares in 2028?

The current share price of Pidilite is Rs 2784.50, but by 2028 it can reach the level of Rs 5,426.20 to Rs 5886.30.

What is the target price for Pidilite shares in 2025?

The highest target price for Pidilite shares is Rs 3989.25 to Rs 4348.80 by 2025.

How can I buy Pidilite shares?

You can buy through a brokerage firm by opening a Demat/Trading account.

What is the maximum target price of Pidilite shares in 2030?

The maximum target price of Pidilite shares in 2030 is Rs 7354.45 to Rs 7932.55.

Disclaimer: Price predictions on our website (banksala.com) are for general information only. Any material we provide should not be considered financial advice. Trading is an uncertain business, please consult your financial advisor before investing.