Tata Power Share Price Target 2024, 2025, 2027, 2030, 2040

In today’s blog, we will outline the projected Tata Power share prices for 2024, 2025, 2027, 2030, and 2040. Our research, supplemented by expert advice, covers the company’s growth, share price targets, and other relevant insights.

Tata Group stands as one of India’s most prominent and well-known companies. Investors are particularly interested in Tata Power shares. Despite the generally positive market perception of Tata, it is crucial for investors to be well-informed before making any investment decisions. By the end of this blog, you will have a clearer understanding of Tata Power’s share price targets. Let’s delve into the projections for Tata Power share prices for 2024, 2025, 2027, 2030, and 2040.

What is Tata Power Company?

Tata Power, a leading power-generation company in India and a member of the Tata Group, boasts nearly a century of experience in power generation. The company is also dedicated to producing electricity from renewable energy sources, including hydropower, wind power, and solar power.

Overview Of Tata Power Company

The primary functions of Tata Power Company include power generation, transmission, and distribution. The government provides guidance on utilizing green energy for electricity production, with the goal of achieving zero carbon emissions in the future. Tata Power Company is actively working towards making India a green city.

Since its inception, Tata Power Company has maintained a strong technical foundation, resulting in consistently high net profits. Consequently, the Tata Power Share Price remains strong in the financial market.

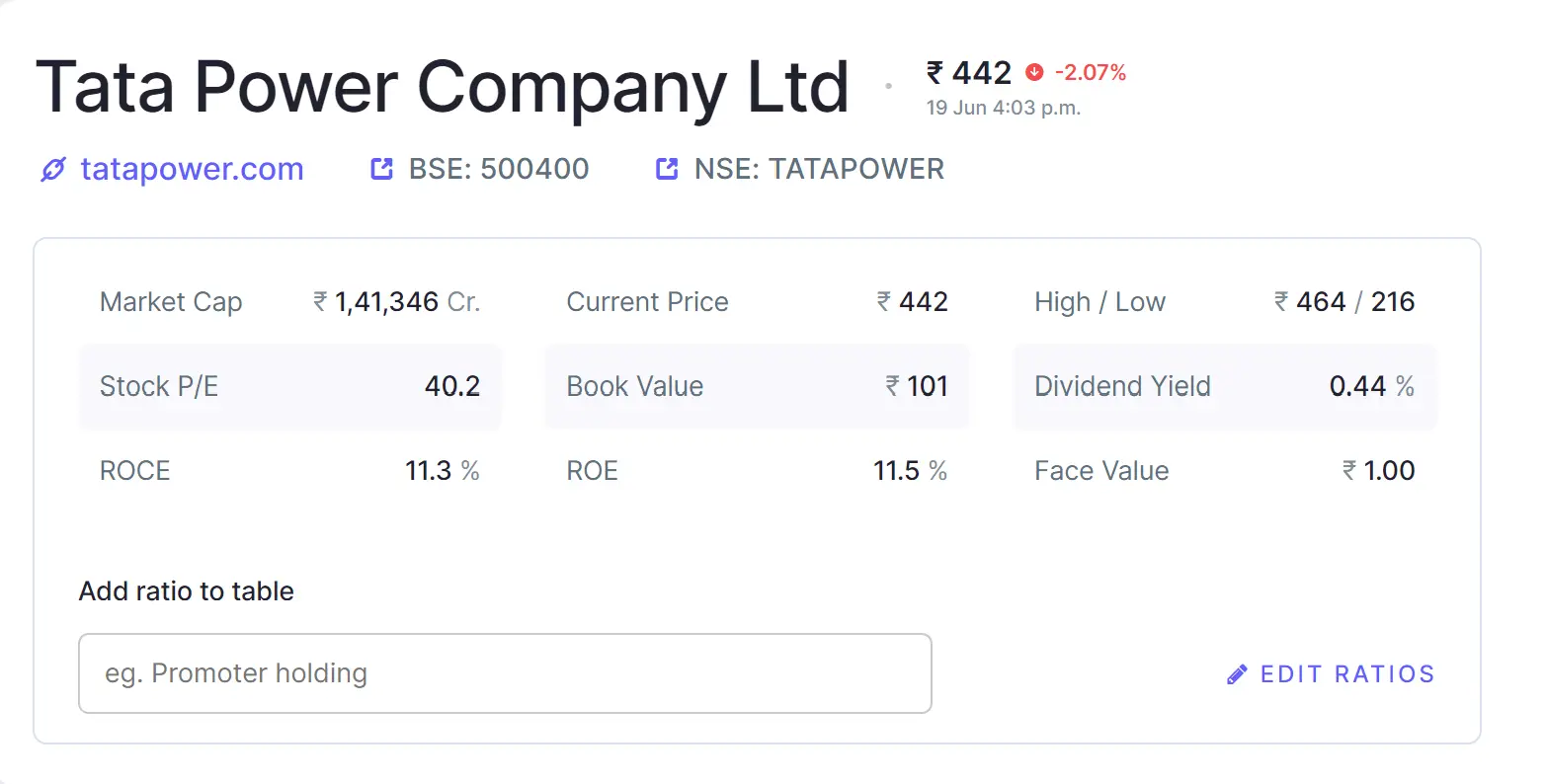

Some important data about company performance

A company’s performance is an important thing for any investor because before investing any share every investor checks the company’s previous performance. Here we try to give some important data that helps to analyze the company’s performance.

PE Ratio (Price To Earning Ratio)

The Price-to-Earnings (PE) Ratio is determined by dividing the market price per share by the earnings per share. This ratio indicates how much an investor is willing to pay relative to the company’s earnings. Tata Power Company has a PE ratio of 44.38, indicating a relatively high valuation.

Return on Assets (ROA)

ROA is determined by dividing Profit After Tax by Total Assets. This metric is affected by two factors: return on sales and asset turnover. Currently, the Return on Assets stands at 5.57%, which is relatively low.

Current Ratio

The current ratio is determined by dividing current assets by current liabilities. Tata Power Company has a current ratio of 0.48.

Return On Equity (ROE)

ROE (Return on Equity) is calculated by dividing net profit by average shareholders’ equity. Tata Power Company has a high ROE of 25.69%.

Some Details About Tata Power Company

| Company Name | Tata Power Company |

| Sector | Power generation |

| Established | In 1915 |

| Head office | In Mumbai, Maharashtra |

| CEO | Mr. Praveer Sinha |

| Founder | Mr.Dorabji Tata |

| PE Ratio | 61.67 |

| 52 Week High | ₹466.56 |

| 52 Week Low | ₹201.75 |

| Products | Power generation, transmission, and distribution. |

Tata Power Share Price Target 2024, 2025, 2027, 2030, 2040

From the very beginning Tata Power Share always rank high. So, if anyone wants to invest in Tata Power Share on a short-term or long-term basis it must be profitable.

Tata Power Company will work as thermal Power and has a Power generation capacity of approximately 14,925MW. Tata Power Company can produce 53% thermal Power around the total plant capacity. Out of which wind (11%), hydro (8%), solar (27%), and waste heat recovery (5%) will be used to produce thermal power.

So, every financial year is important for Tata Power Share because every year it’s grown in a new way. Looking at the company’s cash flow ratio, money turnover ratio, and good market holding capacity every investor is interested in investing in this share.

Tata Power Share Price Target 2024

When discussing Tata Power’s share price target for 2024, it’s anticipated that the price will increase significantly. The company is focusing on generating electricity from green energy sources. In recent years, Tata Power was on par with other companies, but its shift towards renewable energy has drawn government attention. Currently, Tata Power produces electricity through hydropower, solar power, and wind power. Looking ahead, the company aims to increase its renewable energy production to 65%-70%. Below is a list of Tata Power’s share price targets for 2024.

| Month | 1st Price Target | 2nd Price Target |

| January | 355 | 360 |

| April | 410 | 415 |

| July | 440 | 445 |

| September | 465 | 470 |

| November | 492 | 498 |

| December | 500 | 510 |

If anyone wants to invest in Tata Power Share, they can do so because, on a long-term and short-term basis, it is a profitable share. If we look at the Tata Power Share Price Target 2024 forecast, the first price target is ₹355 and the second price target is ₹510.

Tata Power Share PricTarget: 2025

Tata Power Company has the capacity to evolve alongside the latest advancements in the technology market. This capability ensures that Tata Power Company consistently maintains profitability by continuously integrating new technologies into their operations. Below is a compilation of projected Tata Power share price targets for 2025.

| Month | 1st Price Target | 2nd Price Target |

| January | 520 | 525 |

| March | 540 | 545 |

| May | 560 | 565 |

| September | 600 | 632 |

| November | 650 | 655 |

| December | 660 | 665 |

Net sales consistently rise annually. To boost sales, Tata Power expands its market reach. As part of the esteemed Tata Group, known for its strong market reputation, Tata Power maintains favorable cash flow ratios, market share, and net sales figures. Consequently, Tata Power shares attract significant investor interest. Looking ahead to Tata Power’s projected share price targets for 2025, the first target stands at ₹520, with the second target set at ₹665.

Tata Power Share Price Target: 2027

Tata Power Company has planned to set up over 100,000 electric vehicle charging stations across India. As a result, the company’s EV infrastructure could extend to around 400 cities nationwide, with potential expansion into international markets. Tata Power has shown strong financial performance, boasting a significant profit growth of 75.23%. This growth underscores its ability to capture market share and generate substantial returns. Below is a list of Tata Power’s share price targets for 2027.

| Month | 1st Price Target | 2nd Price Target |

| January | 930 | 935 |

| March | 950 | 955 |

| June | 1010 | 1030 |

| September | 1060 | 1065 |

| November | 1100 | 1110 |

| December | 1125 | 1135 |

Tata Power Company has achieved an impressive Return on Equity (ROE) of 25.69%, reflecting its effective capital utilization and strong returns for shareholders. Looking ahead, analysts predict the stock price of Tata Power could potentially reach ₹437.25 within the next year. The company is intensifying its focus on renewable energy with significant investments in new projects. Upon completion, these initiatives are expected to bolster profitability and enable energy production with minimal environmental impact. Looking further ahead, Tata Power’s Share Price Target for 2025 forecasts ₹930 as the first target and ₹1135 as the second target.

Tata Power Share Price Target 2030

Tata Power Company has embarked on initiatives to generate electricity through diverse means. Utilizing water’s energy, turbines produce electricity via water pumps. Additionally, the company is implementing solar roofs, which absorb sunlight through solar panels for electricity production. These eco-friendly endeavors are contributing to a significant increase in the company’s net revenue, marking a growth rate of 32.23%. This, in turn, has also bolstered Tata Power’s share price. Looking ahead, the company’s shares are expected to achieve substantial appreciation due to its solid reputation. Below is a maintained list of projected Tata Power share price targets for 2030.

| Month | 1st Price Target | 2nd Price Target |

| January | 1600 | 1610 |

| March | 1645 | 1650 |

| September | 1775 | 1780 |

| November | 1790 | 1800 |

| December | 1810 | 1820 |

Tata Power Share Price Target 2040

If Tata Power Company successfully completes all its ongoing renewable energy projects, it stands to significantly boost its revenue, potentially elevating Tata Power shares to favorable positions.

Tata Power is currently implementing advanced methodologies instead of traditional approaches, incorporating cutting-edge technologies, investing in new equipment, and employing intelligent management practices. Over the next 10 to 15 years, these initiatives are expected to substantially expand Tata Power Company’s business. The company is also aiming to transition its operations to achieve 100% reliance on green energy, further bolstering its long-term sustainability goals.

| Year | Tata Power Share Price Target |

| 1st Price Target (2040) | 2700 |

| 2nd Price Target (2040) | 2750 |

Investor types and ratio of Tata Power Share

There are mainly four types of Investors in Tata Power Company.

Promoters Holding (48.85%)

Promoters Holding means how much capital is invested by company promoters (owner of the company) through overall capital. For Tata Power Share promoter holding capacity is 48.85%.

Public Holding (24.84%)

Public Investors an individuals who invest in the public market for profit in the future (large and small companies). For Tata Power Share public Holding capacity is 24.84%.

FII (Foreign Institutional Investors) 10.91%

Foreign Institutional Investors are those big companies that invest in different countries company. For Tata Power Share FII is 10.91%.

DII (Domestic Institutional Investors) 15.40%

Domestic Institutional Investors (like Insurance, companies mutual funds) who invest in their own country. For Tata Power Share FII is 15.40%.

Should I Invest or Not In Tata Power Share right now?

In recent years, Tata Power Company has transitioned its energy sources to renewable options such as hydro, wind, and solar rooftops. With increasing electricity demand, the company anticipates substantial future profits. Potential investors interested in Tata Power Company are encouraged to carefully assess the company’s overall profitability, revenue growth, and shareholding capacity before making any investment decisions. Seeking advice from financial experts is advisable prior to investing. Looking ahead to 2024, it is expected that Tata Power shares will achieve a favorable position, making them a potentially profitable long-term investment.

Advantages and Disadvantages of Tata Power Share

Every share has some advantages and some disadvantages also. So, Tata Power Share also has some advantages and disadvantages which are described below.

Advantages

- Tata Power Company demonstrates strong revenue growth, robust market presence, and high sales volume, making it a highly sought-after investment option. The company possesses resilience, boasts experienced technologists, and utilizes sophisticated equipment to effectively navigate challenging scenarios.

- Additionally, governmental initiatives aimed at promoting renewable energy further bolster Tata Power Company’s prospects. Notably, amidst rising coal prices, Tata Power’s emphasis on renewable energy sources for power generation is a significant advantage.

Disadvantages

- There are many power generation companies all over India so in the competitive market there are some difficulties in holding their position.

Conclusion

Hopefully, www.sharetargethub.com can provide you with fundamental insights into Tata Power shares. Through thorough research and expert advice, we believe that Tata Power shares have the potential to achieve significant long-term growth. The company’s net profit is positively influenced by its asset base. Furthermore, investments from foreign companies and the Indian government contribute to this profit growth.

If you find this website useful, please feel free to share it. For any queries, please use the comment box, and we will endeavor to respond and assist you. Thank you for visiting our site and for your continued support.