Titagarh Wagons Share Price Target 2023, 2024, 2025, 2030

Welcome to this article where we delve into Titagarh Wagons (Titagarh Rail Systems Ltd), exploring its operations, profit generation methods, potential growth avenues, and various aspects crucial for understanding the trajectory of Titagarh Wagons’ share price targets.

Following our analysis of the company’s stock, we will present our findings, providing you with insights into this investment opportunity. With promising growth prospects, Titagarh Wagons represents a compelling long-term investment choice. This article specifically discusses Titagarh Wagons’ share price targets for 2023, 2024, 2025, and 2030.

Before delving into the stock’s price targets, let’s review the company’s background, technical fundamentals, fundamental analysis, shareholder structure, and future potential. This comprehensive overview aims to assist you in making informed investment decisions. To begin, let’s explore the company’s history and its overall business structure.

Titagarh Wagons Company Overview

Titagarh Rail Systems Ltd was founded on July 3rd, 1997 by Mr. Jagdish Prasad Chowdhary with a focus on manufacturing railway carriages. Based in Kolkata, West Bengal, the company operates primarily in the railway, defense, shipbuilding, and mining sectors.

In terms of quality management, the company holds ISO 9001:2000 and BS EN ISO 9001:2000 certifications. Its core products include freight cars, warships, mining equipment, rolling stock, and locomotives.

Titagarh Wagons Pvt Ltd specializes in manufacturing freight wagons, metro trains, passenger wagons, train electronics, and steel castings for railways, ships, warships, and bridges. The company’s operations span across India and internationally, generating 76% of its revenue domestically and 24% from Italy.

With four manufacturing plants across India, Titagarh Rail Systems Ltd also includes Titagarh Bridges and International Pvt Ltd as its subsidiary.

Financially, the company has seen stable sales over the past five years, but recently reported a 16% growth due to a strong order book this year. Despite a debt of ₹353 crore, the company maintains a healthy cash reserve of ₹860 crore.

Titagarh Wagons Share Price Target 2023

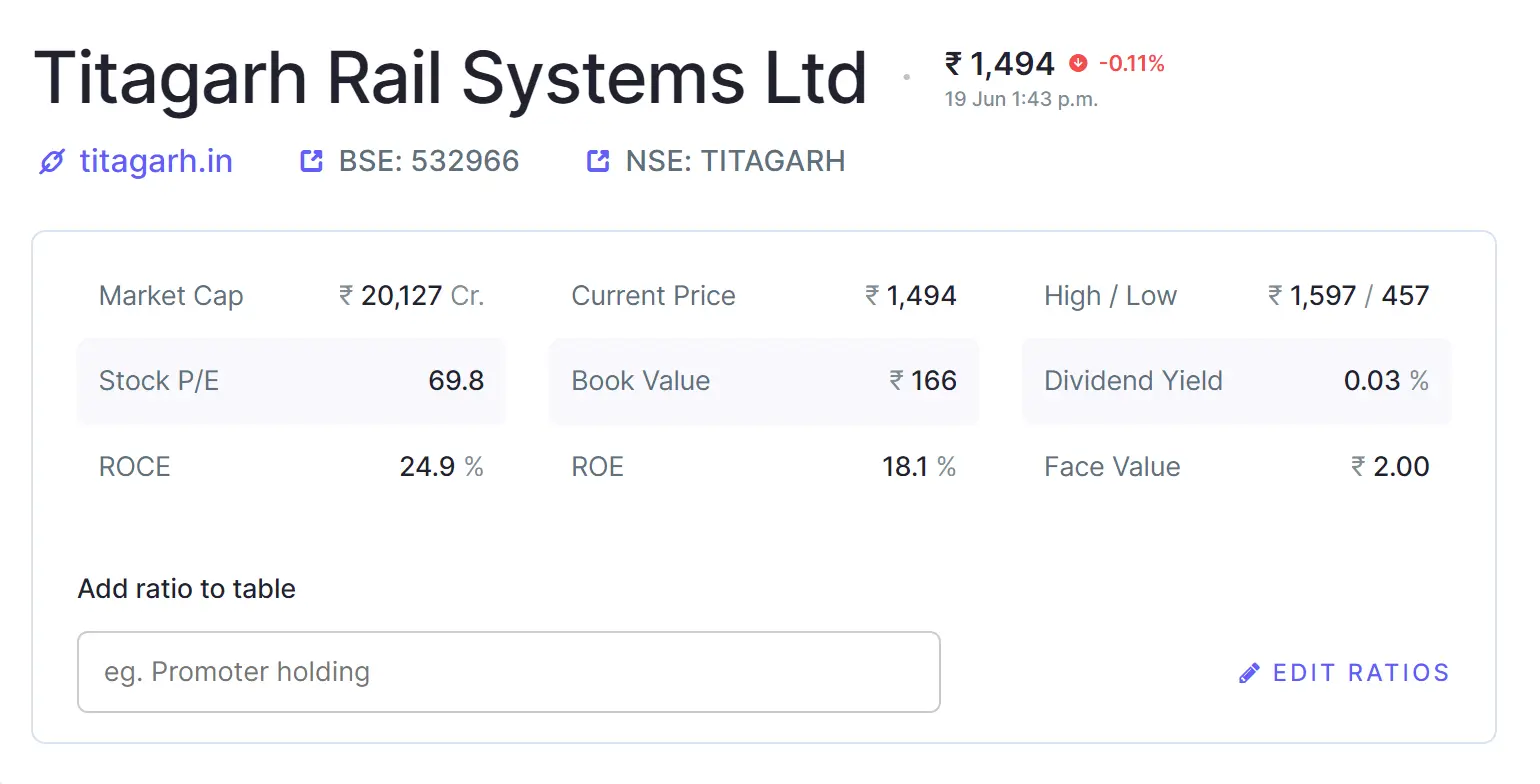

The company holds a market capitalization of ₹9,961 crore, accompanied by a free cash flow of ₹34.38 crore. The developer’s stake in Titagarh Wagons stands at 44.97%.

With a sales growth of 43.77%, the company has achieved a corresponding profit growth of 57.94%.

Titagarh Wagons boasts an enterprise value of ₹7,645.98 crore, with a total share count of ₹12.72 crore. The company’s stock metrics include a P/E ratio of 73.15, a P/B ratio of 6.05, a face value of ₹2, and a book value of ₹98.31.

The company demonstrates an ROE (Return on Equity) of 8.69% and an ROCE (Return on Capital Employed) of 15.92%. Its dividend yield to investors stands at 0.08%.

Overall, Titagarh Wagons is viewed as a fundamentally robust company, supported by a strong promoter holding history, albeit with considerations for managing its debt levels.

Looking ahead, analysts project Titagarh Wagons’ share price to potentially reach ₹1100 in 2023, with a secondary target of ₹1360.

Titagarh Wagons Share Price Target 2024

Over the past five years, Titagarh Wagon Share Company has shown notable growth in its financial performance. In March 2018, the company reported net sales of Rs 313.96 crore, which surged to Rs 1,060.41 crore in March 2019, further increasing to Rs 1,484.21 crore in March 2020, followed by Rs 1,025.79 crore in March 2021, and finally reaching Rs 1,474.79 crore in March 2022. Regarding net profit, the company recorded Rs 2.92 crore in March 2018, followed by a loss of Rs 55.30 crore in March 2019, a loss of Rs 79.92 crore in March 2020, a profit of Rs 50.28 crore in March 2021, and concluding with a profit of Rs 79.41 crore in March 2022.

Considering both net sales and net profit figures over the past five years, Titagarh Wagon Share Company has demonstrated strong performance, especially noteworthy when excluding the challenging period during the COVID-19 pandemic. Looking ahead, optimistic projections are being made for the company’s future prospects. Consequently, in the Titagarh Wagons stock price target for 2024, the first target is set at approximately ₹1800, with a second target projected to reach ₹2200.

Titagarh Wagons Share Price Target 2025

Rewritten paragraph:

By analyzing the returns granted to its investors, the company has achieved a Compound Annual Growth Rate (CAGR) of 52% over the past 5 years, and a CAGR of 142% over the past 3 years, including the last year.

The company’s exceptional CAGR of 363% underscores its ability to deliver significant returns to investors over both short and long terms, with expectations of maintaining similar performance in the future.

As for Titagarh Wagons’ share price targets by 2025, the initial target could reach ₹2600, with a secondary target potentially reaching ₹2900.

Titagarh Wagons Share Price Target for 2026

Titagarh Wagons has several ongoing projects that are currently in progress. The timely completion of these projects could significantly boost the company’s business prospects. Some key projects include:

Surat Metro Rail Project: Titagarh Wagons has secured a contract worth Rs 857 crore to supply 24 metro train sets (comprising 72 carriages) for the Surat Metro Rail project. These trains will be manufactured at the company’s Kolkata plant and are slated for delivery by December 2024.

Manufacture of Vande Bharat Trains: In collaboration with Bharat Heavy Electricals Limited (BHEL), Titagarh Wagons is set to manufacture 80 Vande Bharat trains for Indian Railways. The manufacturing will take place at the company’s Singur plant in West Bengal, with deliveries expected by 2029.

Wheel Manufacturing Plant: Titagarh Wagons, in partnership with Ramkrishna Forgings, is establishing a wheel manufacturing plant in West Bengal. This facility, scheduled to commence operations in 2025, will have an annual capacity of 200,000 wheels. These wheels will be supplied to Indian Railways and other railway companies in India and abroad.

Given these developments, analysts foresee Titagarh Wagons achieving a share price target of approximately Rs 3100 to Rs 3400 by 2026.

Titagarh Wagons Share Price Target 2030

Analyzing the company’s shareholding structure reveals that the promoter holds 44.97% of the shares, with the public holding 33.32%, FIIs holding 12.6%, and DIIs holding 9.11%.

The promoters’ stake in the company stands at 44%, suggesting that if the company experiences growth in the future, Titagarh Wagons’ share price could potentially achieve its first target of Rs 5200 and its second target of Rs 5800 by 2030.

Titagarh Wagons Share Price Target Table

| Years | Targets (₹) |

|---|---|

| 2023 | 1st Target- Rs.1100 |

| 2nd Target- Rs.1360 | |

| 2024 | 1st Target- Rs.1800 |

| 2nd Target- Rs.2200 | |

| 2025 | 1st Target- Rs.2600 |

| 2nd Target- Rs.2900 | |

| 2026 | 1st Target- Rs.3100 |

| 2nd Target- Rs.3400 | |

| 2030 | 1st Target- Rs.5200 |

| 2nd Target- Rs.5800 |

Future of Titagarh Wagons Share

Titagarh Wagons Limited (TWL) is an Indian firm specializing in the manufacturing of rail and metro wagons.

India’s economy is experiencing rapid growth, largely driven by expanding railway infrastructure. The Government of India aims to further enhance railway networks to sustain and bolster economic expansion.

Following defense, the government allocates substantial funds to the railway sector, prioritizing its development and expansion.

TWL demonstrates robust growth and profitability, strategically positioned to capitalize on India’s increasing reliance on rail transportation.

Factors likely to positively influence Titagarh Wagons’ stock price include:

- Increasing Demand for Rail Transport: With one of the world’s largest rail networks, India’s ongoing railway modernization efforts are expected to boost demand for wagons, benefiting TWL.

- Strong Order Book: TWL has secured orders exceeding ₹10,000 crore (US$1.3 billion) in recent years, providing clear revenue visibility and potential for continued order intake.

- Capacity Expansion: Investing ₹2,000 crore (US$260 million) in new facilities by 2024, TWL aims to meet rising product demand.

- Export Expansion: TWL has already exported wagons to Bangladesh, Sri Lanka, and Mexico, with plans to explore new international markets.

Overall, TWL is well-managed and positioned to capitalize on India’s growing rail transport sector. However, potential risks include economic slowdowns impacting demand and increased competition from global players, which could pressure TWL’s margins.

Furthermore, TWL’s stock valuation, with a PE ratio of 59.7 as of November 21, 2023, suggests that investors are paying a premium, necessitating careful consideration of future earnings growth.

In conclusion, while TWL offers strong growth prospects, investors should weigh these factors when considering investment in its shares.

Strength Of Titagarh Wagons Share

- The company has achieved a CAGR of 363% in the last year.

- The company has recorded a profit growth of 50.90% in 3 years.

Weakness Of Titagarh Wagons Share

- The company has recorded revenue growth of 11% in the last 3 years.

- It has registered an ROE of 1.6% in the last 3 years.

Disclaimer: Dear readers, please note that we are not authorized by SEBI (Securities and Exchange Board of India). The content on this website is intended solely for informational and educational purposes and should not be construed as financial advice or stock recommendations. Additionally, any predictions regarding share prices are provided for reference purposes only and are contingent upon favorable market conditions. Factors such as uncertainties surrounding a company’s future or current market conditions are not factored into these predictions. While our aim is to provide informative updates on the stock market and financial products, we do not assume responsibility for any financial losses that may occur as a result of relying on information from this site. We encourage you to conduct your own research before making any investment decisions.

Conclusion

This article serves as a comprehensive guide to Titagarh Wagons’ Share Price Targets, offering insights into the company’s profile, business operations, and projected share prices for 2023, 2024, 2025, 2030, 2035, 2040, and 2050.

Our share price projections are derived from extensive analysis, research on company fundamentals, historical data, expert insights, and technical analyses. We also delve into Titagarh Wagons’ future prospects and growth potential in detail.

We hope this information equips you with comprehensive details on Titagarh Wagons’ share prices, aiding your investment considerations for the future. For any inquiries, please feel free to reach out to us through the comments section.