BHEL Share Price Target 2024, 2025, 2027 to 2030

Hello everyone, if you’re considering potential investment opportunities, understanding the BHEL Share Price Target could be crucial. In this blog post, we delve into a comprehensive analysis of BHEL’s share price outlook from 2024 to 2030. Our research incorporates insights from industry experts, covering aspects such as the company’s growth trajectory, financial performance, business strategies, shareholding patterns, and annual price forecasts. This article aims to provide valuable information for investors interested in BHEL shares. Let’s explore the BHEL Share Price Target for the period spanning 2024 to 2030.

What Is Bharat Heavy Electricals (BHEL) Ltd Company?

Bharat Heavy Electricals Ltd is one of the largest engineering and manufacturing companies that is engaged in the design, engineering, construction, testing, commissioning, and servicing of different products from different sectors. The company was established in the year 1964, on 13th November.

Overview Of BHEL Company

The company specializes in manufacturing power equipment and is actively involved in renewable energy sectors such as thermal power, gas, hydro, nuclear, and solar PV transmission. It also operates within the transportation sector, defense and aerospace industries, and addresses emissions in the oil and gas sector. Furthermore, the company plays a significant role in the development of EV chargers. Governed by the central government, it is 64% government-owned, with its headquarters located in New Delhi.

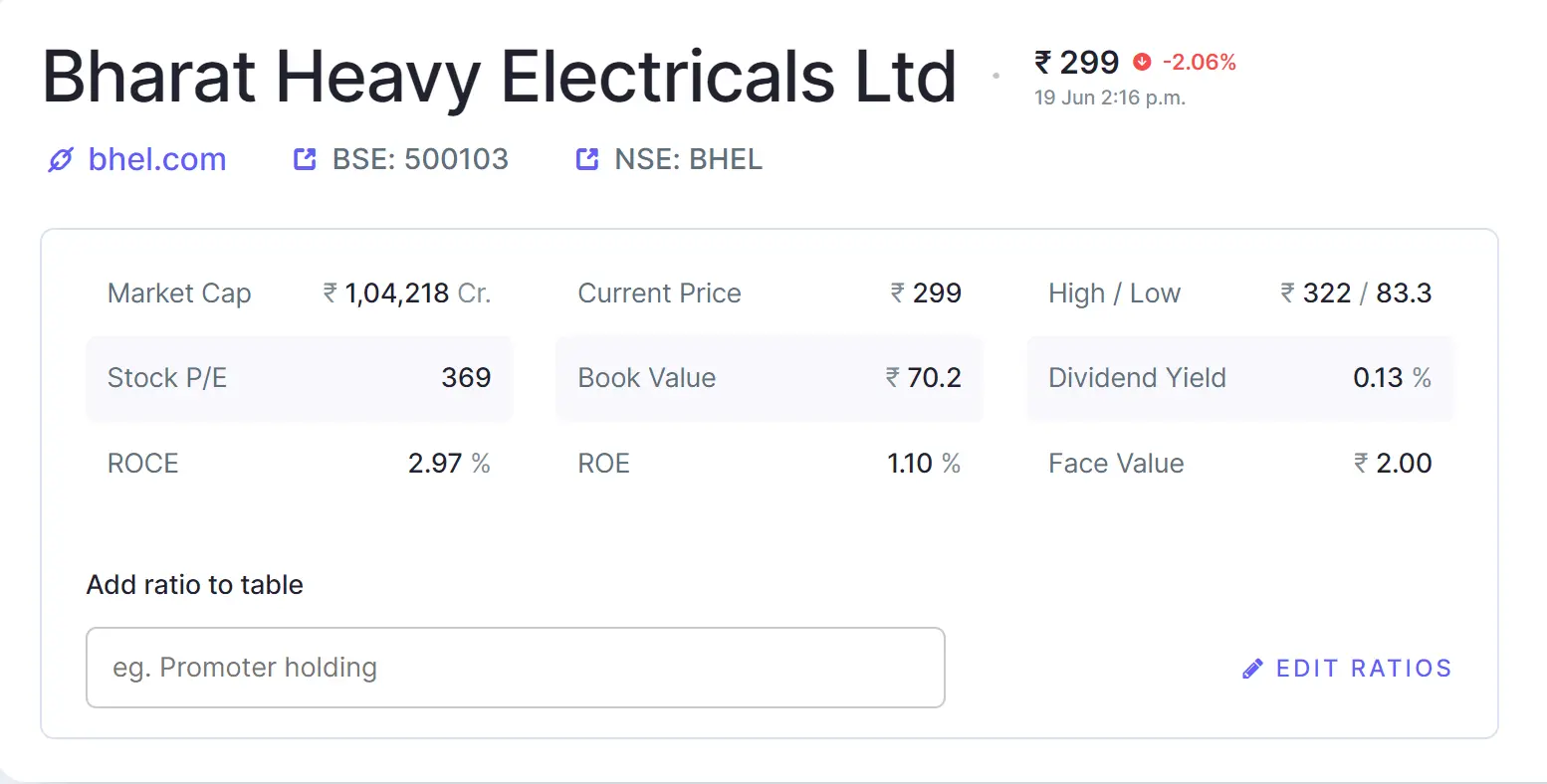

| Company Name | Bharat Heavy Electricals Limited |

| Established | In 1964 |

| Market Cap | ₹1,06,412.63 Crore |

| DIV. YIELD | 0.16% |

| Book Value | ₹76.12 |

| Face Value | ₹2 |

| 52 Week High | ₹319.25 |

| 52 Week Low | ₹77.35 |

| CEO | Mr. Nalin Singhal |

BHEL Company operates as a versatile manufacturer, producing batteries, locomotives, steam turbines, generators, industrial valves, switchgears, and sensors, among other products. Its exports span across 89 countries, including India and the USA.

With 16 manufacturing units, 4 regional offices, and 15 regional marketing centers nationwide, BHEL is actively involved in over 150 ongoing projects across India and internationally. The company boasts a workforce of over 30,000 employees, including 9,000 engineers, highlighting its extensive business capabilities and significant sales growth.

Financial Data Analysis Of BHEL Company

Prior to investing in any shares, it is essential to evaluate the company’s performance, including its overall profitability and net sales. Understanding key financial metrics such as the PE ratio, return on assets, current ratio, and return on equity provides a fundamental insight into the company’s financial health. The following section examines the company’s performance, which plays a crucial role in determining the target share price for BHEL based on these metrics.

PE Ratio (Price To Earning Ratio)

The PE ratio is determined by dividing the market price per share by the earnings per share, indicating how much investors are willing to pay relative to earnings. BHEL Company’s PE ratio of -698.12 suggests it is undervalued.

Return on Assets (ROA)

ROA, derived from profit after tax divided by total assets, is affected by two main factors: return on sales and asset turnover. BHEL Company exhibits a ROA of 0.85%, indicating relatively low performance in this metric.

Current Ratio

The current ratio, derived from dividing current assets by current liabilities, stands at 1.30 for BHEL Company.

Return On Equity (ROE)

The return on equity (ROE) is calculated as the ratio of net profit to average shareholder equity. BHEL Company demonstrates an ROE of 1.69%, which falls within the lower end of the spectrum.

BHEL Share Price Target Growing Rate

Within the last 5 years, BHEL Share Price Target has grown rapidly, which is described below.

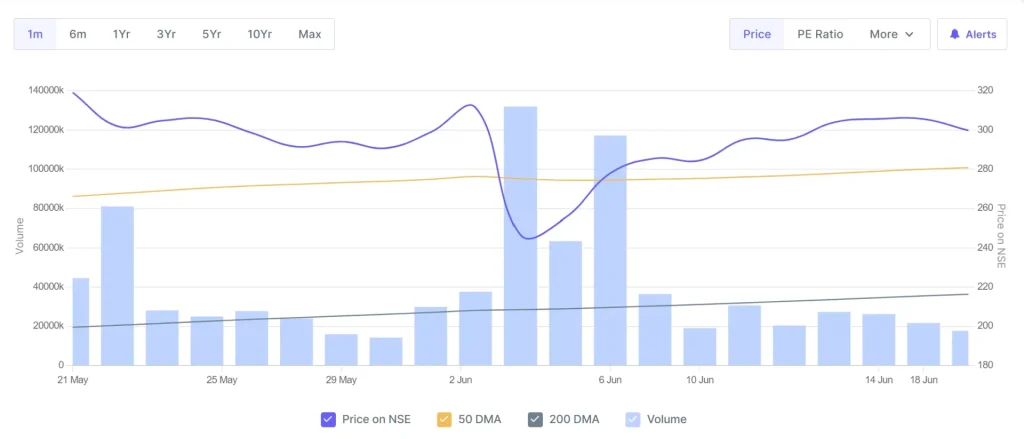

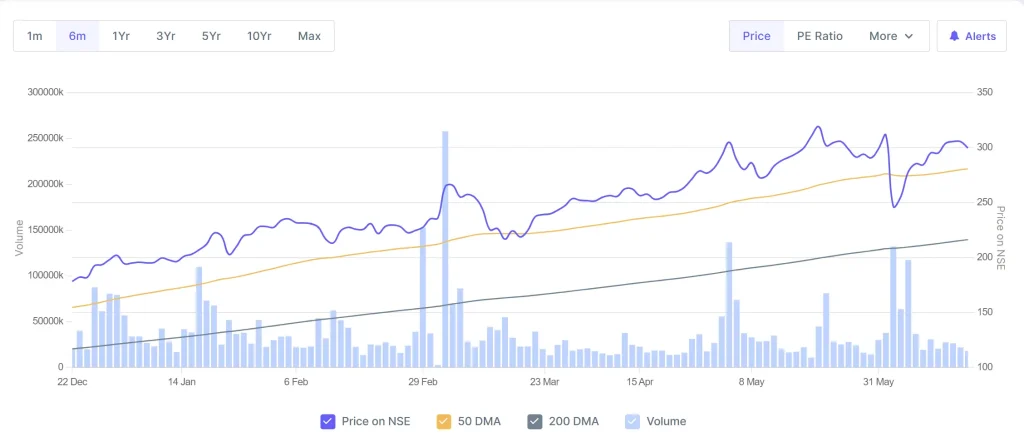

Over the past month, the BHEL share price target rose by 12.24%. Over the last six months, it increased by 91.58%. Looking back over the past year, the share price showed a substantial growth of 254.36%, and over the last five years, it surged by 295.05%. The maximum increase observed in BHEL’s share price reached an impressive 1398.07%.

BHEL Share Price Target 2024, 2025, 2027, 2030

BHEL Share Price Target is a bullish trend in the share market. The is enlisted under BSE (Bombay Stock Exchange) and NSE (National Stock Exchange). As BHEL is a multi-bagger company the company earns profits in different ways. The company is also able to invest money in new production.

Being a power generation and infrastructure company the demand for the company always increases and BHEL Share Price Target also increases. The share always gives good returns to investors. If anyone wants to invest after consulting with expertise they may get good returns on a long-term basis. Let’s have a look at BHEL Share Price Target 2024 to 2030.

BHEL Share Price Target 2024

In the realm of power generation, BHEL incorporates various renewable sources such as nuclear power, hydropower, thermal power, and gas. BHEL possesses the capacity to generate 1,000 MW of power through supercritical sets. Additionally, the company can produce power ranging from 250 MW to 750 MW using turbine generators. BHEL holds the distinction of being India’s pioneering manufacturer of 400 kV Auto transformers.

| Year | BHEL Share Price Target 2024 |

| 1st Price Target | 270 |

| 2nd Price Target | 380 |

BHEL supplies a wide range of equipment across various industries, including oil rings for the oil sector and X-Mas Tree Valves among others. Their product lineup also includes substations, heat exchangers, pressure vessels, and AC machines. Increased production diversity correlates with higher company sales.

This growth not only enhances the company’s financial performance but also boosts its share price. In the previous fiscal year, BHEL achieved a sales growth rate of 11.01%. Looking ahead, BHEL’s share price target for 2024 is ₹270 as the initial target and ₹380 as the secondary target.

BHEL Share Price Target 2025

BHEL company plays an important role in manufacturing and designing Rail Transportation like semi-high speed trains and electric locomotives, bogies, etc. The company supplies more than 850 locomotives the company can manufacture electric locomotives up to 8554 HP. The company also takes an important role in defense and aerospace.

| Year | BHEL Share Price Target 2025 |

| 1st Price Target | 510 |

| 2nd Price Target | 685 |

BHEL serves as a supplier to ISRO, providing solar panels and batteries for satellite research. In aerospace, the company supplies critical products such as heat exchangers for military aircraft and contributes to platform management systems.

Diversifying across sectors has significantly boosted the company’s profit growth, achieving a remarkable 33% increase over the past three years, signaling a promising future. Looking ahead to 2025, BHEL’s projected share price targets are ₹510 as the first target and ₹685 as the second.

BHEL Share Price Target 2027

BHEL Company plays an important role in the E-Mobility sector. The company produces EV charging infrastructure which is solar-based chargers situated in city areas and highways. The first E-Mobility was established on Delhi Highway. The company launched a solar-based EV charging station all over the country.

| Year | BHEL Share Price Target 2027 |

| 1st Price Target | 965 |

| 2nd Price Target | 1110 |

The company provides a battery energy storage system equipped with various functionalities such as energy time shifting, power smoothing, and frequency regulation. Additionally, it supplies batteries to ISRO for satellite research purposes. BHEL is renowned for its strong market reputation and high promoter holding capacity, currently at 64%, making it an attractive choice for many discerning investors.

BHEL’s shares have historically delivered favorable returns to investors. Looking ahead to 2027, the share price forecast indicates a target of ₹965 as the first target and ₹1110 as the second target for BHEL shares.

BHEL Share Price Target 2030

In the research & development field, BHEL Company set up a good position through the spread of its arms in different sectors. In the Indian Engineering Sector, it spread a good look like the innovation of fluid dynamics, surface engineering, UHV Engineering, power electronics, nanotechnology, etc. For more innovation and increasing product demand and quality, the company always invests a huge amount for more development of the company.

| Year | BHEL Share Price Target 2030 |

| 1st Price Target | 1785 |

| 2nd Price Target | 1920 |

The company expanded its product distribution beyond the USA, engaging in 150 new projects across both India and the USA. Foreign institutional investors (FIIs) constitute 8-9% of the company’s investor base, indicating significant international interest in its shares.

Furthermore, the company serves as a pivotal player in renewable energy, prompting investments not only from the Indian government but also from various other governments keen on fostering environmental sustainability by promoting renewable energy initiatives.

For prospective investors, BHEL’s long-term profitability outlook appears promising. Looking ahead to 2030, the forecasted share price targets are ₹1785 for the first target and ₹1920 for the second target.

How To Purchase BHEL Share?

The most common trading platform for purchasing the BHEL Share is described below.

- Zerodha

- Upstox

- Groww

- Angelone

Peer’s Company Of BHEL

- Aamcol Tools

- Acrow India

- Action Const

- Aeroflex Ind.

- Akar Auto Indus

Investors types and ratio of BHEL Share

There are mainly four main Types of Investors in BHEL Share which are described below. In the ratio of FII the growth of the company depends mostly.

| Public Holder | Promoter Holder | FII | DII |

| 14.96% | 64.01% | 7.01% | 14.02% |

Advantages and Disadvantages Of BHEL Share

Every share has some advantages and some disadvantages also. So, BHEL Share also has some advantages and disadvantages which are described below.

Advantages

- The annual net profit of the company has increased in the last 2 years.

- The company has a good promoter holding capacity which is 64% which helps the company’s growth.

- The company is increasing with zero promoter pledges which is a positive side for the company’s growth.

- The Company has low debt and the cash conversation cycle of the company is -170.12 days which means the company can invest money in the production field.

Disadvantages

The company shows poor revenue growth which is 3.01% in the last 2 years.

- The company has a poor PE Ratio which is -610.56 which effect the company’s growth.

- TTM’s net profit amount falling which negatively affects in company’s growth.

Conclusion

Hopefully, www.sharetargethub.com will help you gain some basic ideas about BHEL Share Price Target. By doing the research and taking advice from expertise we ensure that on a long-term basis, BHEL Share Price Target may reach a very high position. BHEL Company is related to the power generation and technology and renewable energy sector. So the demand for this sector also increases which helps the share to gain profit in the future.

If you think this website will be helpful for you then you can share it. If you have any questions please let us know through the comment box we will try to reply to your questions and solve your problem. Thanks for visiting this website and thanks for being with us.