Integra Essentia Share Price Target 2024, 2025, 2030

Since last year, shares of Integra Essentia, a small-cap company, have remained relatively stable, delivering zero returns over the past year despite being listed among multibagger stocks.

LIC holds 48,59,916 shares in the company, equating to a 1.06% ownership in Integra Essentia. The company reported a 200% increase in net income, reaching Rs 62.06 crore for the quarter ending December 2023.

Integra Essentia is one of the country’s penny-multibagger stocks, trading under Rs 10. This small-cap penny stock has risen from Rs 0.39 to Rs 5.60 since the post-COVID period, yielding a 1,350% return over the past three years.

This impressive performance might explain why investors like the Life Insurance Corporation of India (LIC) have retained their confidence in the stock.

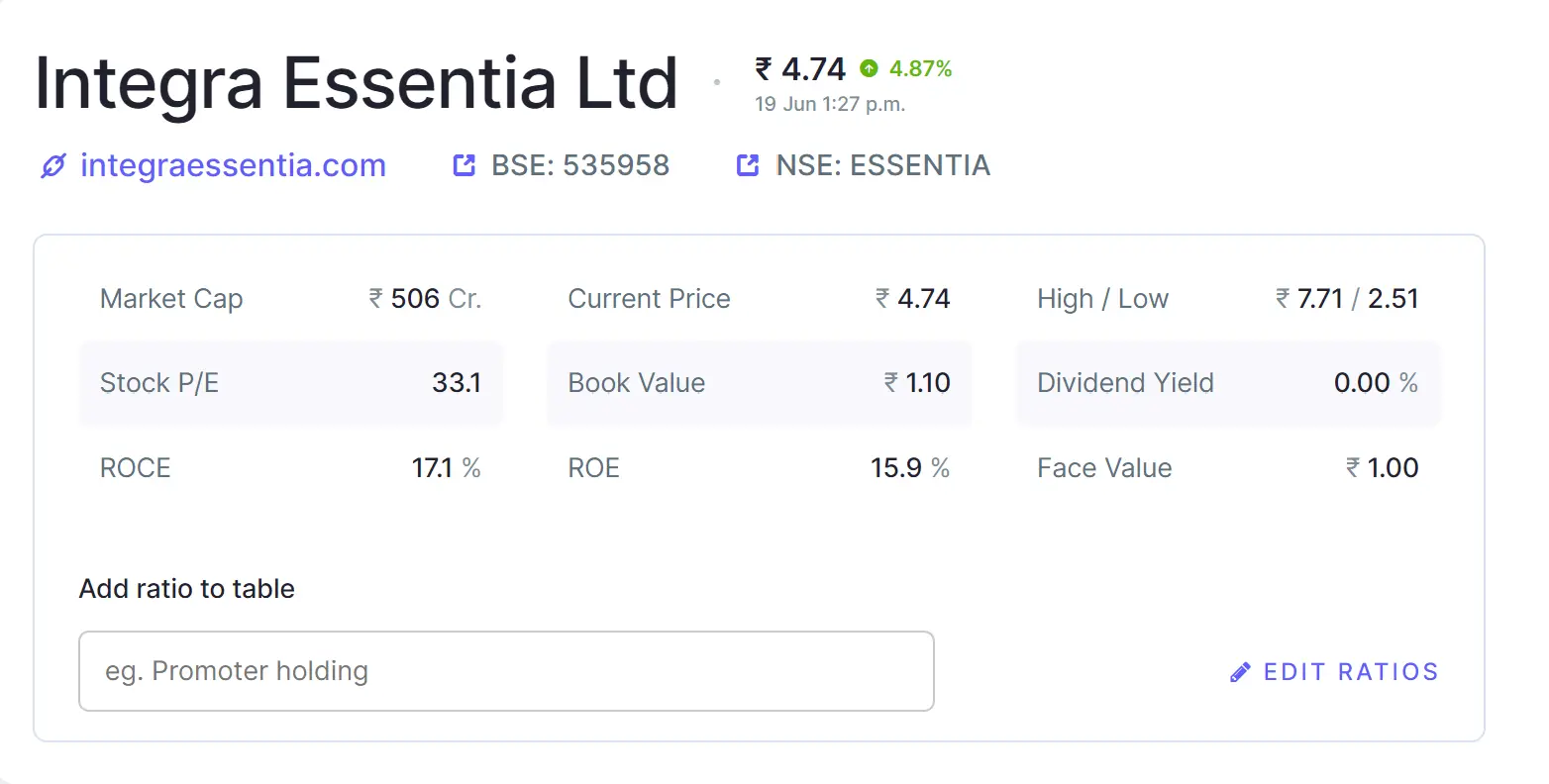

According to the company’s shareholding pattern, LIC maintained its investment during the April-June period. Integra Essentia has a market capitalization of Rs 356 crore.

Shareholding of LIC in Integra Essentia

According to the shareholding pattern of Integra Essentia, LIC held 48,59.916 shares in Q1 FY2024. LIC owns 1.06% of Integra Essentia.

When we examine the shareholding pattern for the smallcap during January-March 20,23, the company still held a 1.06% stake.

Details of the share price

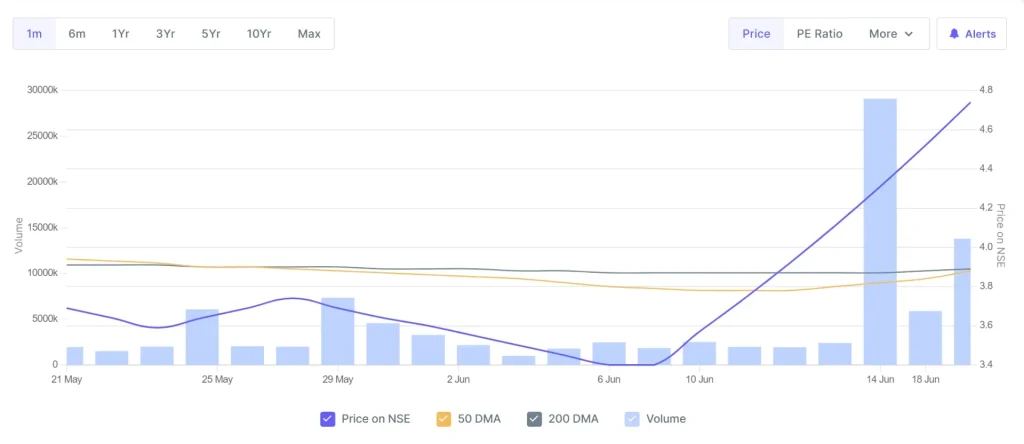

This year, the company’s stock has decreased from Rs 6.85 to Rs 5.60 per share, marking a 20% decline in 2023. Over the past year, the shares of this multi-bagger have dropped by 5%.

However, over the last three years, the stock price has surged from Rs 0.39 to Rs 5.60, delivering a 1,350% return to long-term investors.

Integra Essentia Company Overview

Essentia Company was established in 2007. The company works in Textiles. The company is involved in the production of Garments and Clothing Accessories.

The company’s business was slow for a long time, but in the last year or two, the company has seen a significant increase in sales.

Integra Essentia share price target: 2025

Considering the stock’s future performance over the next two to three years, it appears minimal, with substantial volatility typical of small-sized companies. If the management successfully operates the business efficiently, expands the customer base, and increases manufacturing capacity, resulting in sales growth, the share price could also experience positive growth.

Stock Performance

When we look at the stock performance for the next two to three years, the company will be a small one. The stock volatility of small companies is high.

If the management of the company is successful at running the business and increasing the manufacturing capacity, as well as expanding its client base, then good growth will be seen along with its sales growth.

Is It The Right Time To Buy This Company’s Share?

The company’s stock price has been on a continuous upward trend, making it now 10 times higher than its P/B ratio. As a penny stock, it is managed by the company’s leadership, who also have control over the stock.

For potential investors, it’s advisable to invest small amounts of your hard-earned money into this penny stock.

If the company’s owners hold a stake in the stock, even a small investment could yield significant returns.

This stock has the potential to be a top-performing multibagger penny stock, promising excellent returns in the near future.

Disclaimer: Dear readers, please note that we are not authorized by SEBI (Securities and Exchange Board of India). The content on this site is intended solely for informational and educational purposes and should not be interpreted as financial advice or stock recommendations. Share price predictions provided here are for reference only and are valid only under positive market conditions. Any uncertainties about the company’s future or the current market state are not considered in these predictions. While our aim is to offer timely updates on the stock market and financial products to assist you in making informed investment decisions, we are not liable for any financial losses incurred from the use of information on this site. Always conduct your own research before making any investment decisions.