Jio Financial Share Price Target 2024, 2025 to 2040

Today on our blog, we aim to elucidate the projected trajectory of Jio Financial’s share prices for 2024, 2025, 2027, 2030, and 2040. Our insights are derived from comprehensive research and expert consultations, focusing on the company’s growth prospects, anticipated share price targets, and more.

Jio Financial Services Ltd, a subsidiary of Reliance Jio, will be the focal point of this discussion, delving into its growth trends, future market valuation, and operational dynamics. For those considering investment in Jio Financial shares, this blog promises to offer valuable insights by the end, enabling a clearer understanding of the company’s anticipated share price targets. Let’s delve into the Jio Financial share price targets for 2024, 2025, 2027, 2030, and 2040.

What is Jio Financial Services Ltd Company?

Jio Financial Services Ltd is an independent entity within Reliance Industries. Formerly known as Reliance Strategic Investment Limited, the company rebranded in July 2023. It operates as a non-banking financial company and has emerged as a significant player in the financial sector. The chairman of the company is Mr. Mukesh Ambani.

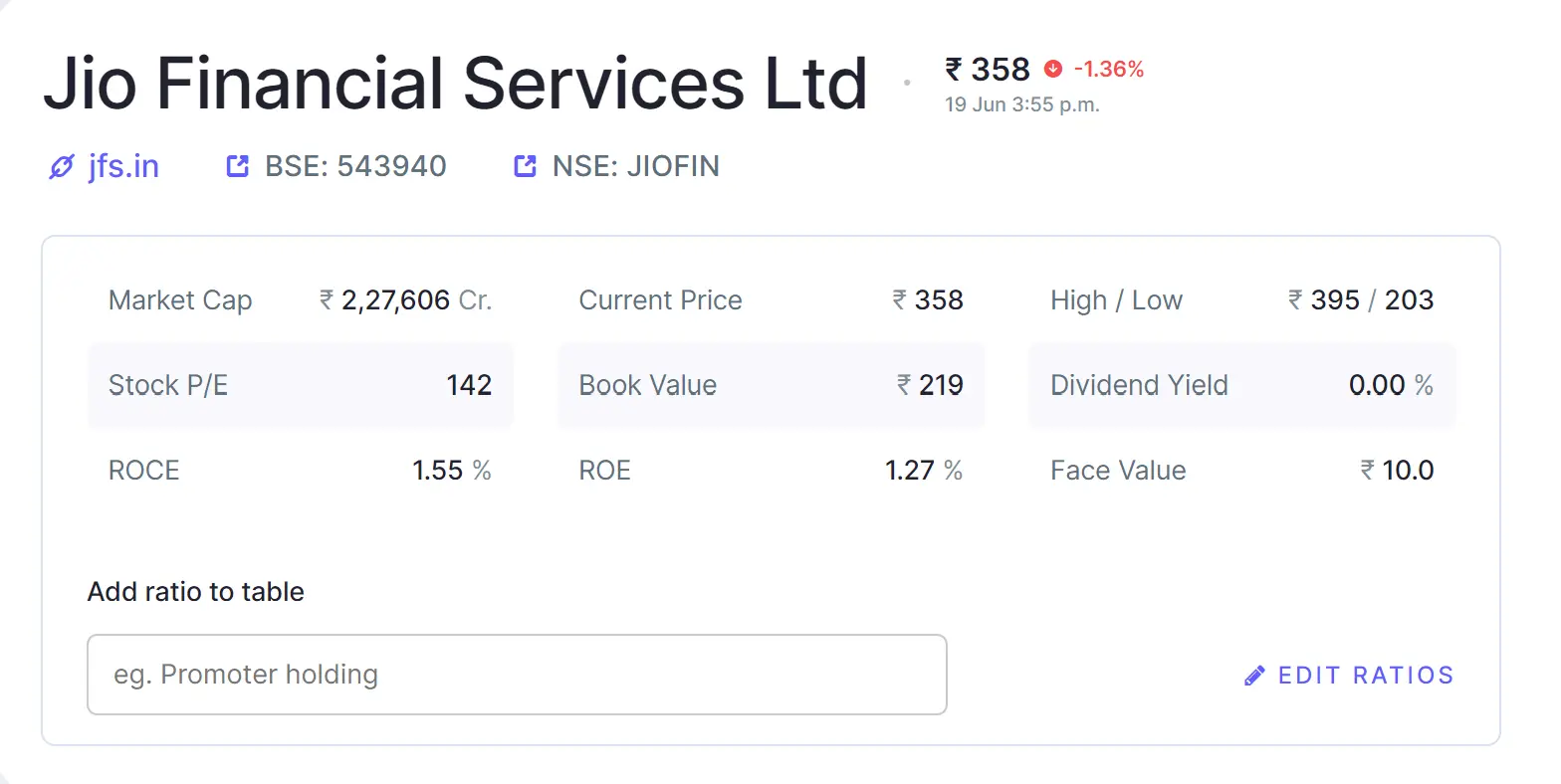

Overview About Jio Financial Services Ltd Company

Jio Financial Services Ltd is listed on both the BSE (Bombay Stock Exchange) and NSE (National Stock Exchange). Its headquarters are located in Mumbai. The company primarily focuses on offering loans to individuals and businesses, along with providing payment solutions, retail finance, banking, insurance, digital banking, and mutual funds services.

| Company Name | Jio Financial Services Ltd |

| Market Cap | ₹2,28,568.16 Crore |

| Face Value | ₹10 |

| 52 Week High | ₹395.23 |

| 52 Week Low | ₹202.80 |

| NSE Sine | JIOFIN |

Jio Financial Services Ltd Company also launched some insurance facilities like life insurance, health insurance, etc. In the Indian story, the company will be marked as the beginning of the first digital institution. The company also reaches our Indian economy to a new destiny.

Annual Performance Of Jio Financial Services Ltd Company

We require fundamental insights into the company’s PE ratio, return on assets, current ratio, and return on equity. The following section delves into the company’s performance, influencing the price target of Jio Financial Shares based on these ratios.

| PE Ratio | Return On Assets (ROA) | Current Ratio | Return On Equity (ROE) |

| 140.23 | 1.56% | 31.23 | 0.61% |

Jio Financial Share Price Target 2024, 2025, 2027, 2030, 2040

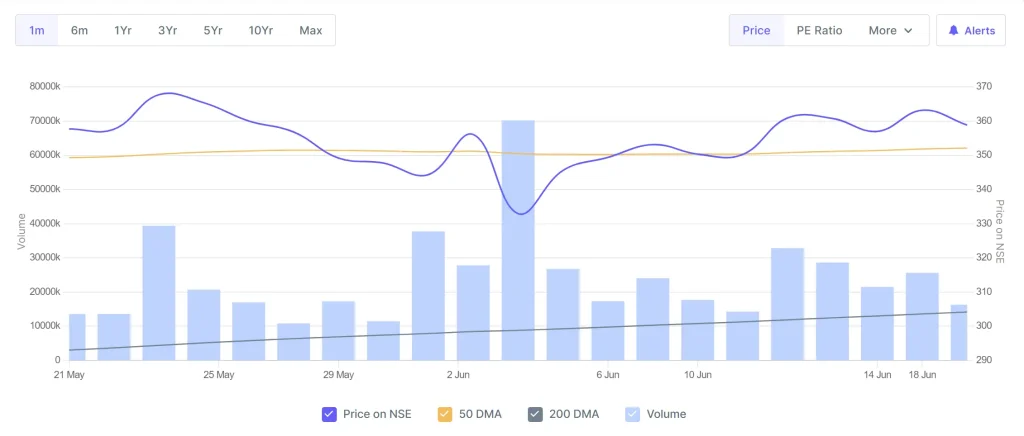

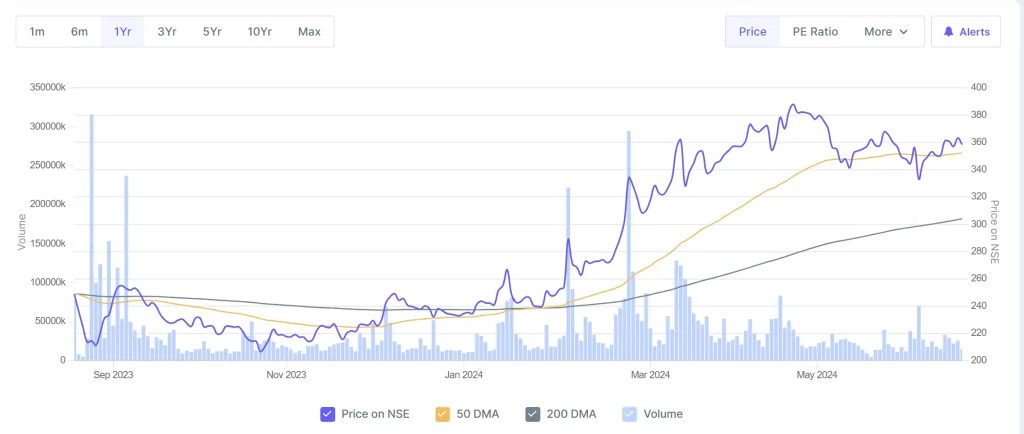

Jio Financial’s shares were listed on the stock market at ₹260 on August 21, 2023, following their demerger from Reliance Industries. Subsequently, due to significant selling pressure, the share price began to decline, triggering lower circuit limits in the short term. The continuous selling of the stock led to a downward trend in Jio Financial’s share price target.

Over the coming six months, digital financial services are expected to expand significantly, leveraging Jio Financial’s integration within Reliance Industries, renowned for its robust market presence and secure data management practices. Experts predict that Jio Financial’s share price could potentially ascend to unprecedented heights in the financial sector between 2024 and 2040. Let’s delve into Jio Financial’s projected share price targets from 2024 to 2040.

Jio Financial Share Price Target 2024

According to the analyst, the primary motive for investing in Jio Financial Share in the stock market is to achieve significant financial returns. The company expands its business across various sectors by offering a range of financial services including personal loans, home loans, educational loans, and others. Jio Financial Share provides diverse services such as personal loans, consumer durable loans, merchant trade credit facilities, and more to enhance profitability and broaden its market reach.

| Year | Jio Financial Share Price Target 2024 |

| 1st Price Target | 340 |

| 2nd Price Target | 415 |

Jio Financial’s share price has experienced significant growth. On December 7, 2023, the share price was ₹249.15, which has now risen to ₹335.00 as of 23rd February 2023, 3:30 pm. Industries across the board are increasingly adopting digital non-banking processes, which bodes well for the company’s future growth. Looking ahead to 2024, the forecasted Jio Financial Share Price Targets are ₹340 as the first target and ₹415 as the second target.

Jio Financial Share Price Target 2025

One of the pivotal aspects of the company involves initiating the process of net banking. Through this system, individuals gain access to comprehensive banking services via a mobile app. They can effortlessly manage tasks such as opening and closing accounts, applying for loans, and depositing funds, all without needing to visit a physical bank branch. Jio Financial Services Ltd. is widely esteemed for providing these convenient and essential services.

| Year | Jio Financial Share Price Target 2025 |

| 1st Price Target | 430 |

| 2nd Price Target | 500 |

In recent times Jio Financial Services Ltd company’s growth has been limited because it recently demerged from Reliance Industry. But in the future, the company will grow rapidly. The total assets amount of the company in March 2022 was ₹2100.12 Crore but on March 2023 the amount became ₹2412.25 Crore. To gain more profit company also invests more assets. If we look at Jio Financial Share Price Target 2025 forecast the 1st Price Target is ₹430 and the 2nd price is ₹500.

Jio Financial Share Price Target 2027

Since the company is affiliated with Reliance Industries, its promoter holding is robust. With a 48% stake held by promoters, this signifies strong potential for the company’s expansion. Given Reliance Industries’ established market position, numerous discerning investors are keen on investing in Jio Financial Share Price Target, which consistently yields favorable returns to shareholders.

| Year | Jio Financial Share Price Target 2027 |

| 1st Price Target | 810 |

| 2nd Price Target | 840 |

Jio Financial Services Ltd benefits significantly from mutual funds, which contribute a substantial portion to its profits. The company has achieved a net profit margin of 33%, driven by robust cash flow. This financial strength allows the company to invest effectively, whether it faces losses or profits. Looking ahead to Jio Financial’s share price forecast for 2027, the first price target is ₹810, with a subsequent target of ₹840.

Jio Financial Share Price Target 2030

The company exhibits strong financial performance with a PE Ratio of 5112.23, a P/B Ratio of 8.17, and a Book value of ₹37.25, indicating robust growth prospects. Moreover, the company has shown impressive revenue growth. Its expanding national presence has attracted significant FII interest, with foreign investors keen on investing in its shares, further bolstering its growth trajectory.

| Year | Jio Financial Share Price Target 2030 |

| 1st Price Target | 1325 |

| 2nd Price Target | 1410 |

Looking ahead, Jio Financial Services Ltd has the potential to significantly impact the financial and mutual fund sectors. There is a growing interest among people in mutual funds, and leveraging Reliance Industries’ robust data management and customer base, Jio Financial can secure a strong foothold in the finance market.

The future share price forecasts are contingent upon the company’s overall performance. Investors considering a long-term investment in these shares can expect promising returns. Jio Financial’s projected share price targets for 2030 are ₹1325 for the first target and ₹1410 for the second target.

Jio Financial Share Price Target 2040

The company provides a personal loan starting at ₹30,00 for self-employed applicants. Under the Consumer Durable Loan, they offer the option to purchase furniture and high-end electronic items with zero-cost EMI and no down payment. The Merchant Trade Credit Facility extends a credit limit of up to ₹10 lakh with zero-cost EMI. The company aims to serve 1.43 billion Indians by offering straightforward and innovative products and services.

| Year | Jio Financial Share Price Target 2040 |

| 1st Price Target | 2,175 |

| 2nd Price Target | 2,230 |

In December 2023, the company’s net profit increased to ₹71.23 crore, rising to ₹78.57 crore by March 2024. Similarly, operating revenue grew from ₹135.23 crore in December 2023 to ₹141.23 crore by March 2024. Looking ahead to the Jio Financial Share Price Target 2040 forecast, the first target price is ₹2,175, while the second target price stands at ₹2,230.

How do I purchase Jio Financial Shares?

The most common trading platform for purchasing the Jio Financial Share is described below.

- Zerodha

- Upstox

- Groww

- Angelone

Investors Types and The Ratio Of Jio Financial Share

There are mainly four main types of Investors in Jio Financial Share.

Promoters Holding (48.12%)

Promoter holding refers to the proportion of capital invested in a company by its owners, known as promoters. In the case of Jio Financial Share, the promoter holding stands at 48.12% of the total capital invested.

Public Holding (18.26%)

Individuals who invest in the public market aim to gain future profits from both large and small companies. The public holding capacity for Jio Financial Share stands at 18.26%.

FII (Foreign Institutional Investors) 19.10%

Foreign Institutional Investors are those big companies that invest in different countries. For Jio Financial Share FII is 19.10%.

DII (Domestic Institutional Investors) 14.52%

Domestic Institutional Investors (like Insurance, companies, and mutual funds) who invest in their own country. For Jio Financial Share DII is 14.52%.

Advantages and Disadvantages Of Jio Financial Share

Every Share has some advantages and some disadvantages. Jio Financial Share also has some advantages and disadvantages which are described below portion.

Advantages

- The book value of the company is increased in the last 2 years which is good for the company’s growth. Jio Financial Share Price Target also increases.

- The company is growing with zero promoter pledges which is a very positive sign for the company’s growth.

- The debt amount of the company is zero which helps the company’s growth.

Disadvantages

- The company has a poor Return On Equity amount (4.50%) which negatively impacts the company’s growth.

- The PAT Margin is poor in rate which negatively affects upon company’s growth.

Conclusion

Hopefully, www.sharetargethub.com will help you gain some basic ideas about Jio Financial Share Price Target. By doing the research and taking advice from expertise we ensure that on a long-term basis, Jio Financial Share Price Target may reach a very high position. As Jio Financial Services Ltd is related to the financial sector. So the demand for this sector also increases which helps the share to gain profit in the future.

If you think this website will be helpful for you then you can share it. If you have any questions please let us know through the comment box we will try to reply to your questions and solve your problem. Thanks for visiting this website and thanks for being with us.

Disclaimer: We are not registered with SEBI as advisors. Financial markets inherently involve risks for all participants. This website is intended solely for educational and training purposes. Therefore, before making any investments, we strongly advise consulting with certified professionals. We do not accept responsibility for any individual’s financial gains or losses.