NHPC Share Price Target 2024, 2025, 2026, 2027 upto 2030

Investing in the stock market can be challenging, especially with countless companies and sectors to consider. However, NHPC Limited has consistently stood out as a top player in India’s hydropower sector. With the upcoming NHPC share price target 2024, many investors are curious about its growth potential and the factors driving its share value. This article will provide an in-depth analysis of NHPC’s share price forecast, covering the factors influencing its growth, financial performance, and potential for long-term investment.

What is NHPC Limited?

NHPC Limited, known as the National Hydroelectric Power Corporation, is a government-owned hydropower board in India. Founded in 1975, NHPC has developed into a primary player in India’s renewable energy sector, primarily focusing on hydropower. It operates under the Ministry of Power and plays a significant role in India’s energy generation landscape. NHPC Limited is involved in planning, promoting, and organizing hydropower development projects across the country.

As the global push for renewable energy intensifies, NHPC is likely to gain more importance due to its contributions to green energy. Many analysts are optimistic about the NHPC share price target 2024, as the company’s growth aligns with India’s renewable energy goals. Below, we’ll examine the company’s financial performance, sector position, and market forecasts.

Read Also: SOUTHBANK Share Price Target 2024, 2025, upto 2030

Financial Performance of NHPC Limited

NHPC has shown stable financial performance in recent years, underpinned by steady revenue and a strong balance sheet. The company’s market capitalization is over ₹80,000 crore, placing it among India’s top hydropower producers. The company’s price-to-earnings (P/E) ratio currently stands at 22.27, and it boasts a dividend yield of approximately 2.37%, which is attractive for long-term investors.

To give a broader perspective, here’s an overview of NHPC’s financials over recent years:

| Metric | Value |

|---|---|

| Market Cap | ₹80,000+ crore |

| P/E Ratio | 22.27 |

| Dividend Yield | 2.37% |

| 52-Week High | ₹118.40 |

| 52-Week Low | ₹49.95 |

| Book Value per Share | ₹38.53 |

| Debt-to-Equity Ratio | 0.84 |

NHPC’s consistent cash flow from operating activities and its low debt-to-equity ratio demonstrate its financial stability, which can contribute to meeting the NHPC share price target 2024. This financial health allows NHPC to continue expanding its projects and maintain its commitment to investors.

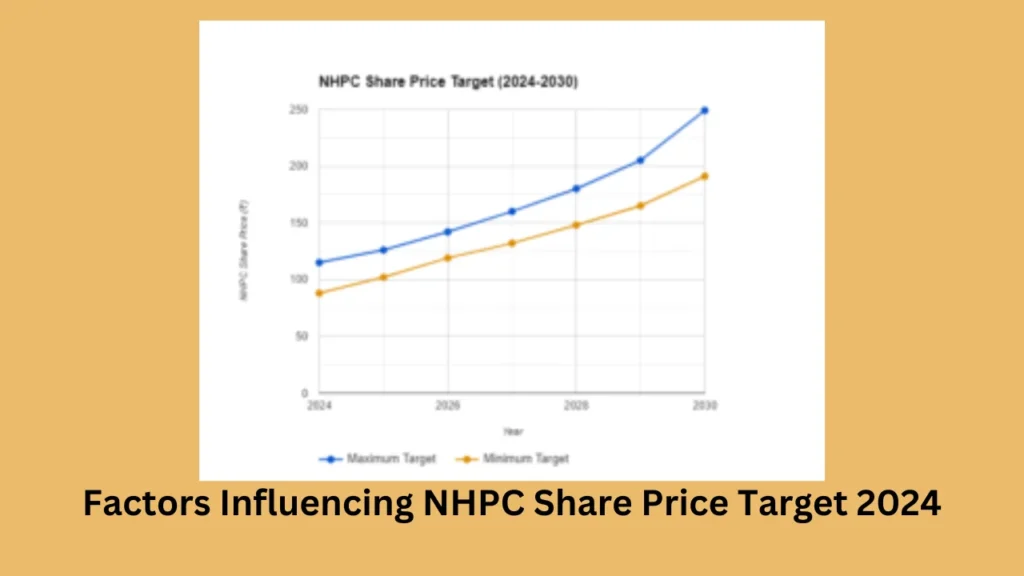

Factors Influencing NHPC Share Price Target 2024

Several factors influence the NHPC share price target 2024. These factors range from government policies to environmental regulations, technological advancements, and NHPC’s strategic expansion.

Government Support and Renewable Energy Policies

NHPC operates as a government entity under the Ministry of Power, ensuring stability in its operations. As India aims to increase its reliance on renewable energy, NHPC will benefit from favorable government policies. The government’s push towards clean energy and reduction in carbon emissions will likely bolster NHPC’s future revenues, positively impacting the NHPC share price target 2024.

Expansion into New Projects

NHPC has undertaken significant hydropower and solar power projects, including an 88 MW floating solar power plant in Madhya Pradesh and other renewable energy projects across India. By diversifying into solar power, NHPC is expanding its renewable portfolio, which can improve its share value as demand for renewable energy grows.

Financial Stability and Dividend Yield

With a stable cash flow and a strong dividend yield of around 2.37%, NHPC appeals to investors seeking steady returns. Its financial stability adds to its attractiveness for long-term investment, contributing to the positive outlook for NHPC share price target 2024.

Market Competition

NHPC competes with other energy giants like NTPC, Power Grid Corporation, and Tata Power. While the competition is robust, NHPC’s focus on hydropower distinguishes it from these companies. This market positioning can lead to stable growth in NHPC’s share price, especially as the world focuses more on sustainable energy.

NHPC Share Price Target 2024: Analyst Projections

Considering NHPC’s strong fundamentals, market analysts have optimistic projections for NHPC share price target 2024. With the company’s initiatives in renewable energy and its government-backed structure, NHPC’s share price is expected to increase gradually over the coming year. Some analysts predict a target of ₹125-₹135 by 2024, driven by the following:

Increased energy demand as India’s population and industries grow.

Stable dividend returns and low-risk profile, appealing to conservative investors.

New project rollouts enhancing revenue streams, such as hydropower and solar plants.

Here’s a projected table for NHPC share prices from 2024 to 2030 based on expert analyses:

| Year | Projected Share Price (₹) |

|---|---|

| 2024 | 125 – 135 |

| 2025 | 140 – 155 |

| 2026 | 160 – 175 |

| 2027 | 180 – 200 |

| 2028 | 210 – 230 |

| 2029 | 240 – 260 |

| 2030 | 280 – 300 |

The NHPC share price target 2024 projection aligns with NHPC’s expansion efforts and stable financial base. Investors should monitor the company’s quarterly financial performance to assess whether these projections hold.

NHPC share price target 2024 on a monthly basis

| Month | Projected Price (₹) | Growth Factors | Market Outlook |

|---|---|---|---|

| January | 100 – 105 | Stable energy demand | Positive start of the year |

| February | 105 – 110 | Increased investor interest | Strong quarterly performance |

| March | 110 – 115 | Favorable market conditions | Rising renewable energy focus |

| April | 112 – 117 | Dividend season attracting investors | Positive financials expected |

| May | 115 – 120 | Strong project execution | Steady market growth |

| June | 118 – 123 | Increased renewable portfolio | Government support continues |

| July | 120 – 125 | Expansion in renewable projects | High investor confidence |

| August | 122 – 127 | Quarterly results showing positive growth | Consistent cash flow |

| September | 125 – 130 | Hydropower project performance | Stable economic environment |

| October | 128 – 133 | Renewed investor interest | Peak financial performance |

| November | 130 – 135 | High energy demand in winter | Seasonal positive trends |

| December | 132 – 137 | Strong year-end performance | Positive outlook for next year |

Why Invest in NHPC?

Investing in NHPC offers a range of benefits, especially for those focused on the renewable energy sector. Here are some reasons why NHPC can be a sound investment for 2024:

Stable Dividends: NHPC’s dividend yield of 2.37% offers steady returns, making it appealing to investors looking for regular income.

Government Ownership: As a government-owned entity, NHPC benefits from stability, reduced operational risks, and policy support.

Renewable Energy Demand: With the global shift towards renewable energy, NHPC is poised to grow, making the NHPC share price target 2024 realistic and achievable.

Low Debt-to-Equity Ratio: NHPC’s low debt level indicates minimal risk, ensuring financial health even during market volatility.

Read Also: ITC Share Price Target 2024, 2025, 2027, 2030, 2035

Risks to Consider

While NHPC has a positive outlook, there are risks that investors should keep in mind:

Dependence on Hydropower: NHPC’s reliance on hydropower exposes it to environmental and regulatory risks. Climate changes affecting water availability could impact its operations.

Market Competition: Despite being government-backed, NHPC faces competition from private and government players. A significant technological shift could affect NHPC’s growth.

Volatility in Stock Markets: External market conditions, such as inflation and economic shifts, can influence NHPC’s share price.

NHPC Share Price Target 2025

| Year | Projected Price (₹) | Growth Factors | Market Outlook |

|---|---|---|---|

| 2025 | 140 – 155 | Energy demand increase | Positive for renewables |

| 2025 | 140 – 155 | Expansion of renewable projects | Favorable government policies |

| 2025 | 140 – 155 | Stable dividend returns | Growing investor interest |

| 2025 | 140 – 155 | Low debt-to-equity ratio | Consistent market stability |

NHPC Share Price Target 2026

| Year | Projected Price (₹) | Growth Factors | Market Outlook |

|---|---|---|---|

| 2026 | 160 – 175 | New solar and hydropower projects | Government support persists |

| 2026 | 160 – 175 | Strong cash flow | Favorable renewable policies |

| 2026 | 160 – 175 | Dividend stability | Positive long-term forecast |

| 2026 | 160 – 175 | Continued expansion efforts | Increasing market demand |

NHPC Share Price Target 2027

| Year | Projected Price (₹) | Growth Factors | Market Outlook |

|---|---|---|---|

| 2027 | 180 – 200 | Renewable capacity increase | Rising demand for green energy |

| 2027 | 180 – 200 | Revenue growth | Supportive government policies |

| 2027 | 180 – 200 | Favorable economic outlook | Positive investor sentiment |

| 2027 | 180 – 200 | Technological advancements | Renewable energy push |

NHPC Share Price Target 2028

| Year | Projected Price (₹) | Growth Factors | Market Outlook |

|---|---|---|---|

| 2028 | 210 – 230 | High dividends | Favorable for renewables |

| 2028 | 210 – 230 | Successful project execution | Increasing investor confidence |

| 2028 | 210 – 230 | Enhanced renewable portfolio | Strong financial backing |

| 2028 | 210 – 230 | New energy projects | Positive market conditions |

NHPC Share Price Target 2029

| Year | Projected Price (₹) | Growth Factors | Market Outlook |

|---|---|---|---|

| 2029 | 240 – 260 | Expansion of hydropower assets | Stable cash flow expected |

| 2029 | 240 – 260 | Positive market positioning | Increasing renewable demand |

| 2029 | 240 – 260 | Growing renewable energy sector | Government policy support |

| 2029 | 240 – 260 | Strong project pipeline | Positive sector outlook |

NHPC Share Price Target 2030

| Year | Projected Price (₹) | Growth Factors | Market Outlook |

|---|---|---|---|

| 2030 | 280 – 300 | Robust renewable portfolio | Long-term growth potential |

| 2030 | 280 – 300 | Strong government backing | High investor confidence |

| 2030 | 280 – 300 | Consistent dividends | Stable economic conditions |

| 2030 | 280 – 300 | Solid financial base | Growing renewable adoption |

Conclusion

The NHPC share price target 2024 reflects the company’s stable performance and potential for growth in India’s expanding renewable energy market. With support from the Indian government and the company’s focus on hydropower and solar energy projects, NHPC is positioned for long-term success. The target price for 2024 is optimistic, but it aligns with NHPC’s project growth and India’s renewable energy goals.

For investors looking for steady returns with a focus on clean energy, NHPC is a viable choice. However, like any investment, it is essential to stay informed about market trends and NHPC’s quarterly performance. With the right strategy, NHPC shares could offer substantial rewards for long-term investors.