Sarveshwar Foods Share Price Target 2023, 2024, 2025, 2026, 2030

Welcome to this article focusing on Sarveshwar Foods Share Price Target. Today, we will delve into Sarveshwar Foods’ operations, profit generation methods, potential growth avenues, and other pertinent details to provide insights into the trajectory of Sarveshwar Foods’ stock price.

Furthermore, we will present our analysis of the company’s stock performance to offer you a comprehensive understanding.

Sarveshwar Foods exhibits promising growth potential, positioning it as a compelling long-term investment opportunity. This article will explore Sarveshwar Foods Share Price Targets for 2023, 2024, 2025, and 2030.

Before delving into the stock price targets, let’s examine the company’s background, technical fundamentals, fundamental analysis, shareholder insights, and future prospects.

This comprehensive review aims to assist you in making informed investment decisions. To begin, let’s examine the company’s history and its overall business structure.

Despite its potential, Sarveshwar Foods faces challenges such as moderate sales growth, low return on equity, and inconsistent profitability without dividends for investors.

Sarveshwar Foods – Company Overview

Welcome to this article focusing on Sarveshwar Foods Share Price Target. Today, we will delve into Sarveshwar Foods’ operations, profit generation methods, potential growth avenues, and other pertinent details to provide insights into the trajectory of Sarveshwar Foods’ stock price.

Furthermore, we will present our analysis of the company’s stock performance to offer you a comprehensive understanding.

Sarveshwar Foods exhibits promising growth potential, positioning it as a compelling long-term investment opportunity. This article will explore Sarveshwar Foods Share Price Targets for 2023, 2024, 2025, and 2030.

Before delving into the stock price targets, let’s examine the company’s background, technical fundamentals, fundamental analysis, shareholder insights, and future prospects.

This comprehensive review aims to assist you in making informed investment decisions. To begin, let’s examine the company’s history and its overall business structure.

Despite its potential, Sarveshwar Foods faces challenges such as moderate sales growth, low return on equity, and inconsistent profitability without dividends for investors.

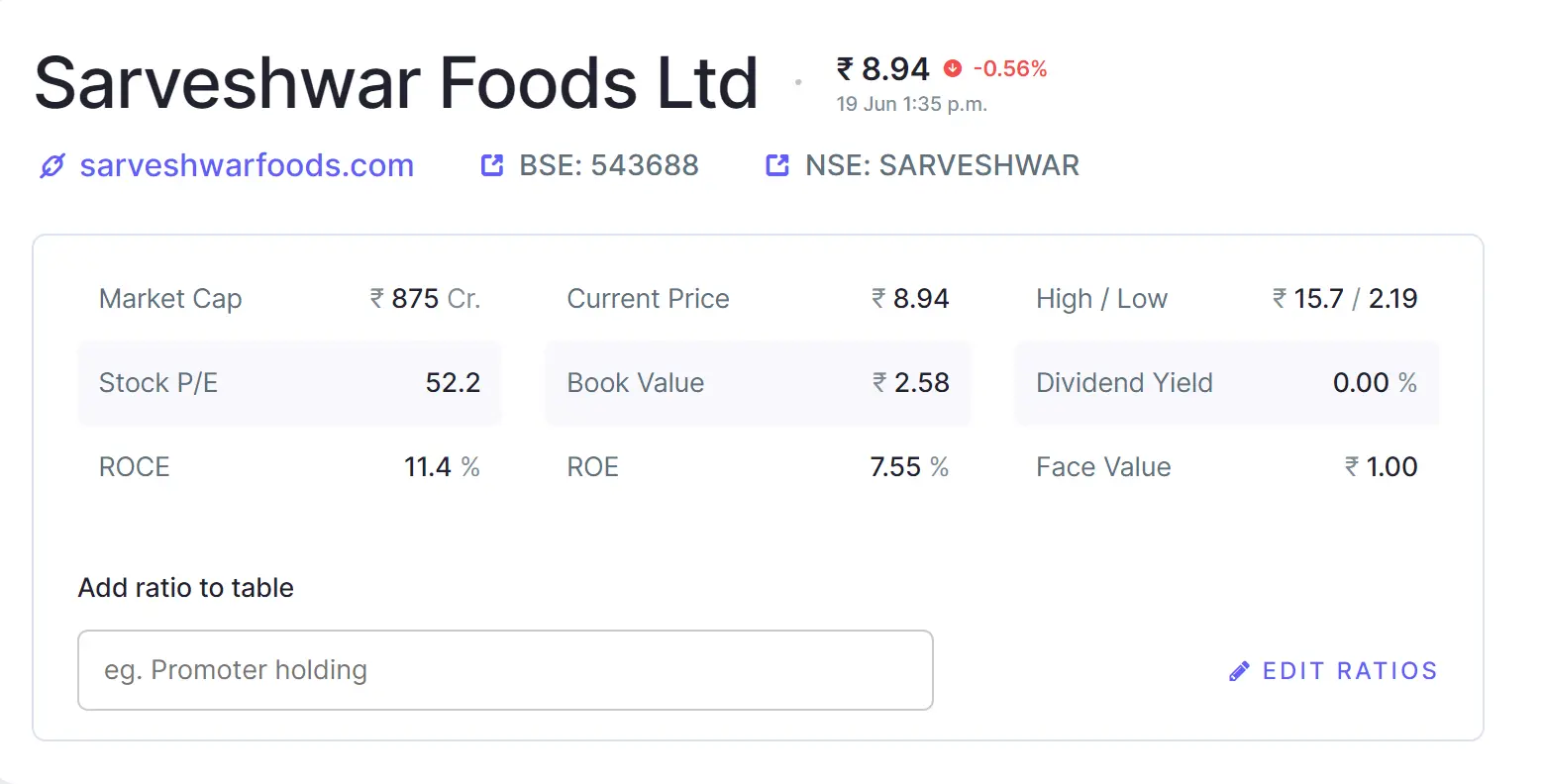

Fundamental Analysis of Sarveshwar Foods

| Parameter | Value |

|---|---|

| Market Cap | ₹ 509 Cr. |

| Current Price | ₹ 5.20 |

| High / Low | ₹ 5.60 / ₹ 1.70 |

| Stock P/E | 64.4 |

| Book Value | ₹ 2.60 |

| Dividend Yield | 0.00 % |

| ROCE | 8.12 % |

| ROE | 4.14 % |

| Face Value | ₹ 1.00 |

| Price to Book Value | 2.00 |

| Price to Earning | 64.4 |

| OPM (Operating Profit Margin) | 5.23 % |

| EPS (Earnings Per Share) | ₹ 0.10 |

| Debt | ₹ 288 Cr. |

| Debt to Equity | 1.35 |

| Return on Equity (ROE) | 4.14 % |

| Return on Assets (ROA) | 1.45 % |

Sarveshwar Foods Share Price Target 2023

Sarveshwar Foods Share Price Target For 2023 As Follows:

| 2023 | 1st Target- Rs.6 |

| 2nd Target- Rs.7 |

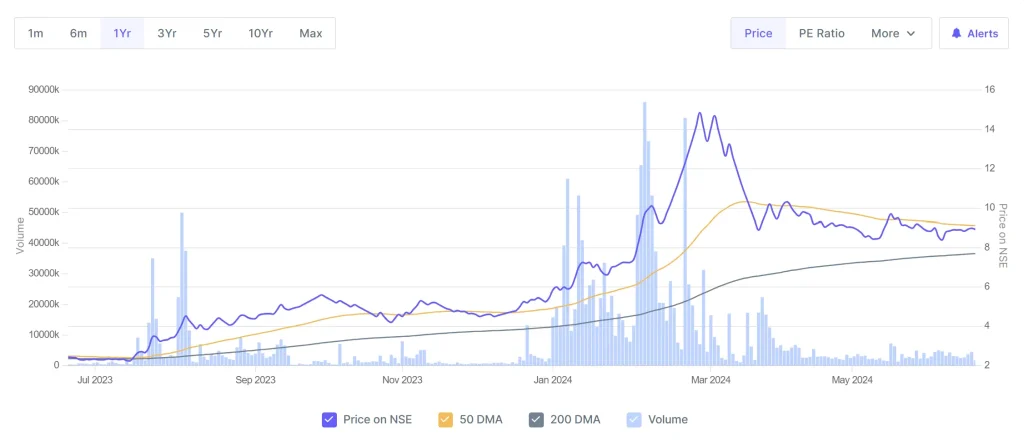

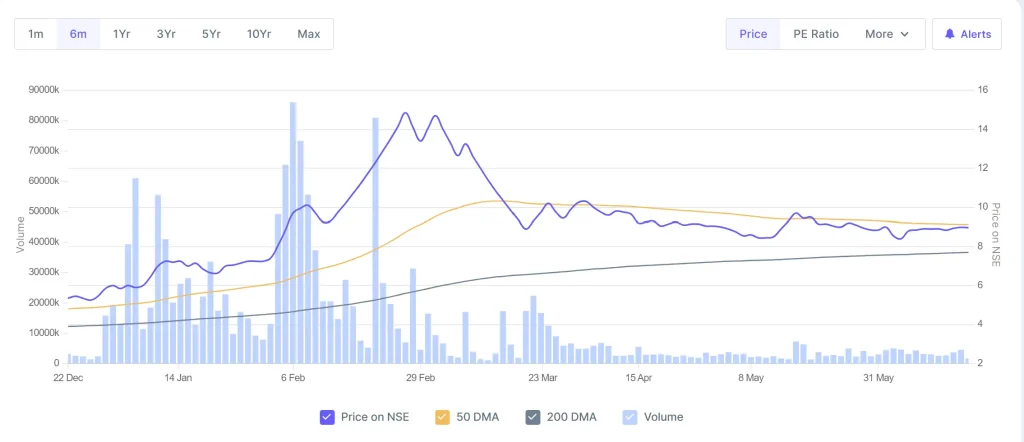

Sarveshwar Foods Share Price Target 2024

Sarveshwar Foods Share Price Target For 2024 As Follows:

| 2024 | 1st Target- Rs.11 |

| 2nd Target- Rs.16 |

Sarveshwar Foods Share Price Target 2025

Sarveshwar Foods Share Price Target For 2025 As Follows:

| 2025 | 1st Target- Rs.18 |

| 2nd Target- Rs.22 |

Sarveshwar Foods Share Price Target 2026

Sarveshwar Foods Share Price Target For 2026 As Follows:

| 2026 | 1st Target- Rs.31 |

| 2nd Target- Rs.45 |

Sarveshwar Foods Share Price Target 2027

Sarveshwar Foods Share Price Target For 2027 As Follows:

| 2027 | 1st Target- Rs.60 |

| 2nd Target- Rs.72 |

Sarveshwar Foods Share Price Target 2028

Sarveshwar Foods Share Price Target For 2028 As Follows:

| 2028 | 1st Target- Rs.110 |

| 2nd Target- Rs.145 |

Sarveshwar Foods Share Price Target 2030

Sarveshwar Foods Share Price Target For 2030 As Follows:

| 2030 | 1st Target- Rs.210 |

| 2nd Target- Rs.248 |

Sarveshwar Foods Shareholding Pattern

- Promoters 54.91%

- Retail And Others 41.33%

- Foreign Institutions 3.76%

Conclusion

This article serves as a comprehensive overview of Sarveshwar Foods Ltd’s shares, providing insights into the company’s identity, its operations, and more.

Our share price predictions are formulated through rigorous analysis, encompassing research into company fundamentals, historical performance, experiential insights, and diverse technical evaluations. Additionally, we delve into Sarveshwar Foods’ future prospects and growth potential in detail.

We hope this information equips you with comprehensive details on Sarveshwar Foods’ share prices, aiding your potential investment decisions in the future. Should you have any inquiries, please feel free to reach out to us via the comments section.

We are here to address any queries you may have and welcome you to share this article widely if you find the information valuable.

The company has shown subpar sales growth, with notably low returns on equity and consistent but modest profit margins, yet it refrains from distributing dividends to its investors.

Disclaimer: Dear readers, we’d like to inform you that we are not authorized by SEBI (Securities and Exchange Board of India). The information on this site is only for informational and educational purposes and shouldn’t be considered financial advice or stock recommendations. Also, the share price predictions are completely for reference purposes. The price predictions will only be valid when there are positive signs on the market. Any uncertainty about the company’s future or the current state of the market will not be considered in this study. Though this is just for informational purposes, We are not responsible for any financial loss you might incur through the information on this site. We are here to provide timely updates about the stock market and financial products to help you make better investment choices. Do your own research before any investment.