IRFC Share Price Target 2024, 2025, 2027 and 2030

In today’s blog post, we will provide an overview of the IRFC share price targets for 2024, 2025, 2027, and 2030. This comprehensive analysis incorporates extensive research and expert insights into the company’s growth trajectory, financial performance, business policies, shareholding patterns, and annual price forecasts, as well as an assessment of its strengths and weaknesses. We aim to prove patterns, and valuable information on IFC’s investment potential, making this article beneficial for current and prospective investors alike. Join us as we explore IRFC’s share price targets from 2024 through 2030.

What is IRFC Company?

The Indian Railway Finance Corporation (IRFC) is a financing arm established by Indian Railways. It was founded on December 12, 1986, with the primary goal of raising funds for infrastructure development within Indian Railways.

Overview Of IRFC Company

IRFC, an Indian Public Sector entity, raises funds from domestic and international markets to finance various projects of the Indian Railway. Headquartered in New Delhi, it operates under the Ministry of Railways and is registered as a non-banking financial company regulated by the Reserve Bank of India.

As of March 31, 2022, IRFC has disbursed over ₹5.05 lakh Crore to the Indian Railway for infrastructure development. This funding has facilitated the construction of 13,769 locomotives, 75,736 passenger coaches, and 255,816 wagons, constituting 75% of the Indian Railway’s total rolling stock. With over 30 years of experience, IRFC plays a crucial role in supporting the growth and expansion of India’s railway infrastructure.

Fundamental Analysis of IRFC Ltd Company

| Company Name | Indian Railway Finance Corporation Limited |

| Market Cap | ₹2,21,672.52 Crore |

| Face Value | ₹10 |

| Book Value | ₹36.72 |

| DIV. YIELD | 0.89% |

| 52 Week High | ₹193.23 |

| 52 Week Low | ₹31.21 |

| NSE Sine | IRFC |

Financial Data Analysis Of IRFC Ltd Company

Before investing any share anyone wants to see the company’s performance, overall profit, and net sales amount. We need a basic idea about the company’s PE ratio, return on assets, current ratio, and return on equity. In the below portion, we discuss the performance of the company. IRFC Share Price Target also depended upon the ratio which is described below.

| PE Ratio | ROA (Return On Assets) | PB Ratio | ROE (Return On Equity) |

| 36.54 | 1.34% | 4.59 | 14.67% |

IRFC Share Price Target 2024 to 2030

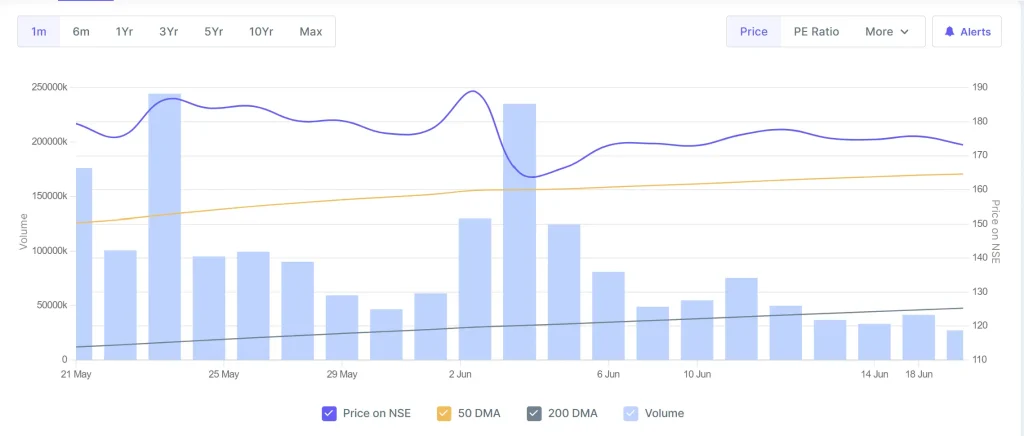

IRFC Share Price Target has gained significant traction in the stock market recently. Listed on both the BSE (Bombay Stock Exchange) and NSE (National Stock Exchange), IRFC’s share price has shown impressive growth. Over the past six months, it surged by +97.60 (198.12%), and in the last year, it saw a remarkable increase of +119.80 (439.12%).

In the last 3 years, the operating income of the company has also grown at CAGR 23% with the company’s growth IRFC Share Price Target also increased if anyone wants to invest the share will be beneficial on a long-term basis. IRFC Share Price Target is a bullish trend in the share market. The forecast of IRFC Share Price Target from 2024 to 2030 is described below portion.

IRFC Share Price Target 2024

The primary role of the company is to raise funds from the financial market to initiate new projects and provide leasing services to Indian Railways. IRFC Ltd operates as a monopoly in this business sector, as its stock exchange transactions are exclusively with Indian Railways. The company has been experiencing annual sales growth of up to 20%. Details of the IRFC Share Price Target for 2024 are outlined below.

| Month | 1st Price Target | 2nd Price Target |

| January | ₹130 | ₹135 |

| April | ₹160 | ₹165 |

| July | ₹205 | ₹210 |

| October | ₹225 | ₹230 |

| December | ₹240 | ₹245 |

In March 2022, the operational revenue was ₹21,256.56, which increased to ₹24,865.56 by March 2023. Focusing solely on the Indian Railway sector promises accelerated growth for the company. Looking ahead to the projected IRFC Share Price Targets for 2024, the first target is ₹130, followed by ₹245 as the second target.

IRFC Share Price Target 2025

In summary, the company has ample opportunities for growth due to Indian Railway’s consistent innovation in infrastructure and related projects. IRFC stands out as the sole investor in Indian Railway ventures. Being a government entity, it attracts keen interest from prominent investors. With a substantial promoter holding of 87%, the company exhibits remarkable growth potential. Below is the IRFC Share Price Target for 2025.

| Month | 1st Price Target | 2nd Price Target |

| January | ₹255 | ₹265 |

| March | ₹280 | ₹290 |

| June | ₹325 | ₹330 |

| September | ₹350 | ₹352 |

| November | ₹360 | ₹365 |

| December | ₹365 | ₹370 |

The profit growth of the company in recent times is slow but the company has scope to grow rapidly in the future. However, the return percentage from the stock market is high. In the last 6 months, the return percentage was 193.25% and in the last 1 year, the return amount was 440.12%. That means the investors are getting good returns from the share. If we look at the forecast of IRFC Share Price Target 2025, the 1st Price Target is ₹255 and the 2nd Price Target is ₹370.

IRFC Share Price Target 2027

IRFC Share Price Target increasing rapidly. On November 30, 2023, the price was ₹74.65 but on February 12, 2024, the price became ₹132.95 which means the amount increasing rapidly. The income growth of the company has increased rapidly in the last 3 years the growth percentage is 18% and last 5 years the growth is 17%. If we look share price target IRFC Share Price Target 2027 list is described below.

| Month | 1st Price Target | 2nd Price Target |

| January | ₹500 | ₹510 |

| March | ₹525 | ₹530 |

| August | ₹580 | ₹585 |

| September | ₹590 | ₹595 |

| November | ₹610 | ₹615 |

| December | ₹620 | ₹625 |

The company has a good ROE percentage which is 15.12% which means the return amount occurs from equity is a good company that also gets an encouragement in investment purposes. If we look at the forecast of share price IRFC Share Price Target 2025, the 1st Price Target is ₹510 and the 2nd Price Target is ₹625.

IRFC Share Price Target 2030

The target share price of IRFC is expected to achieve a favorable position by the end of 2030, contingent upon the company sustaining its current performance and overall growth trajectory. IRFC has raised capital through various financial instruments such as tax-free market borrowings and commercial borrowings from external sources. The anticipated share price for IRFC in 2030 is detailed below.

| Month | 1st Price Target | 2nd Price Target |

| January | ₹925 | ₹930 |

| April | ₹955 | ₹960 |

| July | ₹1010 | ₹1015 |

| October | ₹1030 | ₹1035 |

| November | ₹1040 | ₹1050 |

| December | ₹1055 | ₹1060 |

IRFC collaborates extensively with the government sector and operates with zero debt. The Indian Railway’s numerous upcoming projects are expected to drive the company’s growth. The pre-tax profit was ₹6,190.00 in March 2022, increasing to ₹6,347.01 by March 2023. Investing in IRFC shares could prove advantageous over the long term. Looking ahead to 2030, IRFC’s share price targets are set at ₹930 as the first target and ₹1060 as the second.

Last 5 Year’s Profit Growth of IRFC Company

| Year | Proffit Growth |

| 1st Year (2019) | 4.09% |

| 2nd Year (2020) | 10.23% |

| 3rd Year (2021) | 25.63% |

| 4th Year (2022) | 25.64% |

| 5Th Year (2023) | 26.01% |

How To Purchase IRFC Share?

The most common trading platform for purchasing the IRFC Ltd Share is described below.

- Zerodha

- Upstox

- Groww

- Angelone

Investors Types and The Ratio Of IRFC Share

There are mainly four main types of Investors in IRFC Share which are described below.

| Promoter Holding | Public Holding | FII (Foreign Institutional Investors) | DII (Domestic Institutional Investors) |

| 85.40% | 11.34% | 1.06% | 2.20% |

IRFC Ltd Peer’s Company

| Company Name | Price | Market Cap |

| Capital Trade | ₹47.23 | ₹295.69 Crore |

| Capital Trust | ₹134.25 | ₹220.42 Crore |

| Ceejay Finance | ₹208.25 | ₹72.12 Crore |

Advantages and Disadvantages Of IRFC Share

Every Share has some advantages and some disadvantages. IRFC Share also has some advantages and disadvantages which are described below portion.

Advantages

The company exhibits a strong Promoter Holding capacity, standing at 87%, which significantly supports its growth trajectory. Notably, the company has been expanding without any pledges from its promoters. Over the past two years, there has been an increase in the company’s book value, alongside a rise in its annual net profit.

Disadvantages

The net profit amount declined with the falling profit margin which affected the company’s growth.

Conclusion

For insights into the IRFC Share Price Target. Through research and expert advice, we anticipate significant long-term growth potential for IRFC shares, given its association with the banking sector. Increased sector demand is expected to drive future profitability. If you find our website useful, please consider sharing it. For any queries, feel free to leave a comment, and we’ll address them promptly. Thank you for visiting and your continued support.

Disclaimer: We are not registered with SEBI as advisors. The financial markets inherently carry risk for all participants. This website is purely for educational and training purposes. Therefore, before making any investments, we strongly advise consulting with certified experts. We do not assume responsibility for any individual’s gains or losses.