Servotech Power Systems Share Price Target 2023, 2024, 2025, 2030

Servotech Power Share Price Target: Hello, and welcome to this article. Today, we’ll explore Servotech Power’s operations, profit strategies, growth prospects, and other key details to understand the trends in the company’s share price targets.

We’ll also analyze the company’s stock and share our findings with you, providing insights into this investment opportunity.

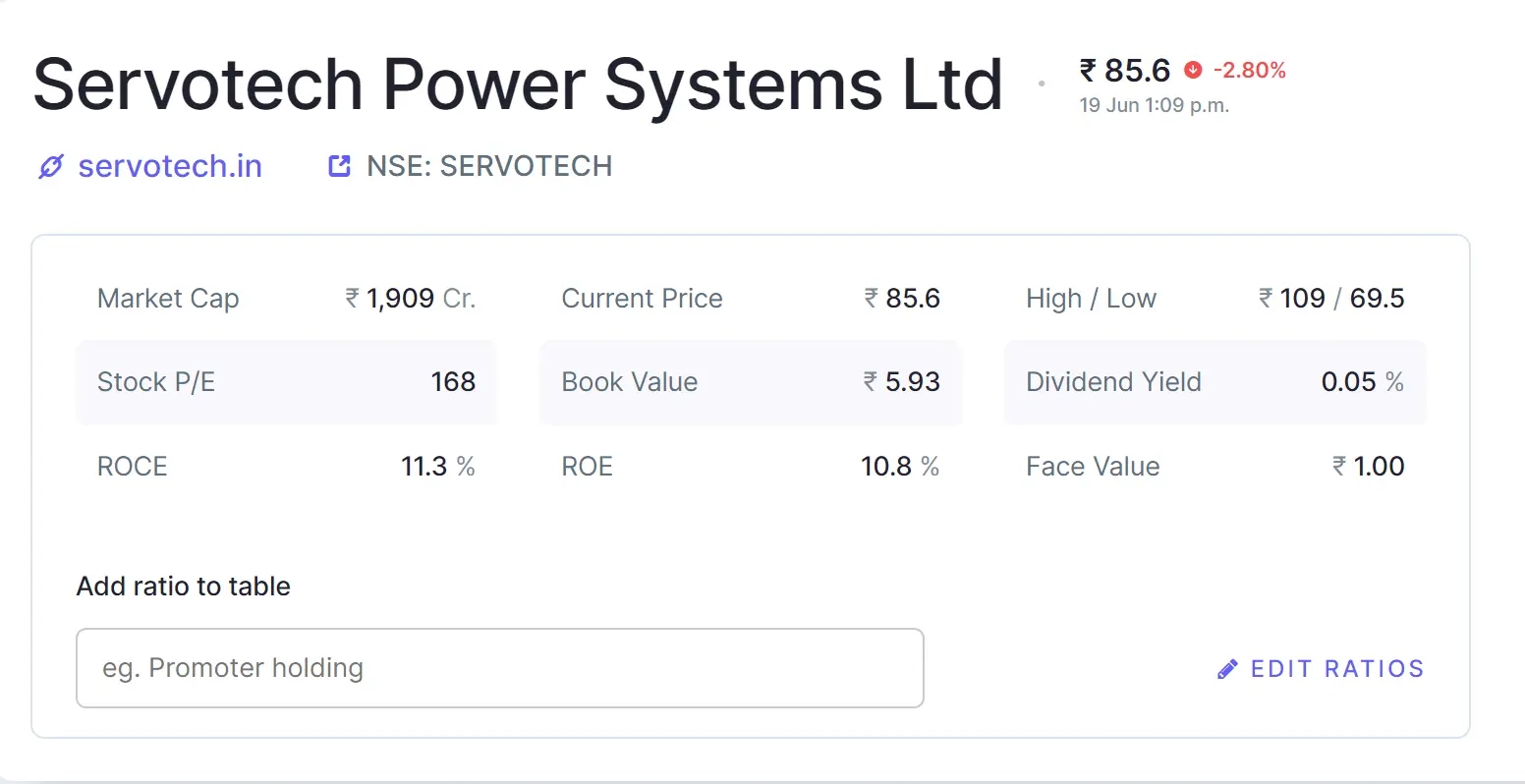

Servotech Power shows strong growth potential, making it an attractive long-term investment. This article will cover Servotech Power Share Price Targets for 2023, 2024, 2025, 2030, and 2040.

Before diving into the stock price targets, we’ll review Servotech Power’s background, technical fundamentals, financial analysis, shareholder information, and future prospects.

This comprehensive overview will assist you in making informed investment decisions. Let’s begin by examining the company’s history and complete business structure.

Stock split has happened in 2023

Servotech shares underwent a split in July this year, with the company dividing its shares into two parts. Servotech Power set the record date for the stock split as July 28, 2023. Consequently, any investor holding the company’s shares on that date benefited from the stock split.

Servotech Power Systems Ltd Company business profile

Servotech Power Systems Limited is a public company established on September 24, 2004, and is classified as a non-government entity registered with the Registrar of Companies in Delhi.

The company has an authorized share capital of Rs. 220,000,000 and a paid-up capital of Rs. 186,654,288.

Founded by Raman and Sarika Bhatia, Servotech Power Systems Limited carved out a niche in the power backup industry by producing inverters, servos, and both online and offline UPS systems.

The company later expanded into manufacturing LED lighting and solar products, focusing on environmentally friendly and sustainable solutions to support the ecosystem.

Within a few years of entering the LED market, Servotech leveraged its dedicated R&D team to revolutionize the industry by offering high-quality LED lighting products at affordable prices.

Currently, the Servotech team is striving to make solar-powered products widely available.

The company’s product portfolio includes solar products, medical-grade PV Ports, solar power oxygen concentrators, flood lights, LED street lights, tube lights, and lithium ferro phosphate batteries.

Servotech generates 90% of its revenue from the lithium batteries segment, with the remaining revenue coming from the solar and lighting segments.

Also Read: This Small Company’s Shares Rose 85% In 4 Months, LIC Has Bought 15,000,000 Shares

To diversify its business, the company’s management is exploring the solar auto rickshaw market, which has significantly boosted sales this year.

Sales have increased from Rs. 85 crore to Rs. 135 crore.

However, the company’s operating profit margin is 5%, which is relatively low, and it must pay Rs. 2 crore in interest on a loan of approximately Rs. 19 crore.

Despite the strong sales performance, the net profit is about Rs. 4 crore, a substantial improvement compared to last year’s net loss of Rs. 1 crore.

The company’s entry into the solar e-rickshaw market has led to impressive sales growth and a stock price increase of up to 1000% over the past year.

Shareholding pattern

- Promoters 60.6%

- Foreign Institutions 9.42%

- N Banks Mutual Funds 0%

- Others 8.27%

- Public 21.7%

Servotech Power Systems share price target

Servotech Power Systems Share Price Targets for 2023, 2024, 2025, and 2030: Is Investing in Servotech Power Systems a Good Long-Term Decision? Is Now the Right Time to Buy?

Over the past year, shares of Servotech Power Systems Ltd. have delivered substantial profits to investors. The stock has generated impressive returns of up to 900%, significantly enriching its shareholders.

This remarkable surge in the company’s stock price can be attributed to exceptional sales growth during the year.

Servotech Power Systems share price target 2023

Since the company announced its excellent quarterly results, there has been a substantial increase in its share value. Given that the company is small with a modest market capitalization, its managers are likely also directly involved in trading its shares.

Looking at Servotech Power Systems’ share price target for 2023, if the company continues to perform well and remains profitable this quarter, its share price is expected to be between Rs 85 and Rs 100. Additionally, there could be a 40% increase in the company’s shares. Consequently, profit-taking is anticipated, which might lead to a decline of 40% to 60% from the higher levels.

Servotech Power Systems share price target 2024

The company has seen a 22% increase in revenue over the past decade. Additionally, revenue has grown from 20% to Rs 140 crore during this period, with minimal sales growth in recent years. However, since expanding into energy-saving switches and solar auto rickshaws, sales have shown significant quarterly increases.

Looking ahead to 2024, Servotech Power Systems may adjust its product range, potentially impacting its share price. Despite market fluctuations, the company anticipates strong sales growth, aiming for a stock target price of Rs 120 by 2024.

Servotech Power Systems share price target 2025

The debt of around 19 crore to the company leaves it very weak. The company also has reserves of cash worth Rs 27 crore.

Its client lists include Indian oil corporations, HP, Gail, Bharat Petroleum, AU Small Finance Bank, Hindware etc. The company’s management has successfully accelerated the size of its business for a while now.

In the near future, the company’s management is expected to engage in new initiatives to increase business sales. Servotech Power Systems’ share price for 2025 is estimated between Rs 125 and Rs 135.

Servotech Power Systems share price target 2030

Looking at the company’s business structure, there is significant potential for growth in the upcoming years. Particularly, the company anticipates a surge in its solar power business and the production of solar auto rickshaws.

Currently, the company operates out of Delhi and runs a manufacturing facility in Sonipat, Haryana, with a production capacity of 3000 items per month.

Over the next few months, the company’s management will focus on establishing a new unit aimed at enhancing production capacity.

If successful, this expansion not only promises increased sales but also potential profit gains, likely reflecting in the company’s stock performance. Despite market fluctuations, Servotech Power Systems anticipates its share price reaching between Rs. 200 and Rs. 235 by 2030.

Disclaimer:

Dear readers,

Please note that we are not authorized by SEBI (Securities and Exchange Board of India). The information provided on this website is intended solely for informational and educational purposes and should not be construed as financial advice or stock recommendations. Predictions regarding share prices are offered strictly for reference purposes. These predictions are contingent upon positive market indicators and do not account for uncertainties regarding a company’s future or the current market conditions.

While our content aims to inform and educate, we do not accept responsibility for any financial losses incurred based on information from this site. Our goal is to deliver timely updates on the stock market and financial products to assist you in making informed investment decisions. It is essential to conduct your own research before making any investment decisions.