Trident Share Price Target 2024, 2026, 2030, Upto 2040

Trident Ltd, a prominent entity listed on the National Stock Exchange (NSE) and Bombay Stock Exchange (BSE), is the subject of our in-depth analysis in this post. We focus on projecting Trident Share Price Target 2024, 2026, 2030, Upto 2040, employing diverse technical analysis methodologies for long-term forecasts.

To envisage TRIDENT’s price trajectory until 2030, we’ll leverage machine learning techniques training forecasted data on historical performance. Renowned for its notable presence in the Indian share market, Trident Ltd has exhibited varied trends. In this segment, we delve into TRIDENT’s current market stance, growth trajectory, and the potential impact of external market dynamics on its price performance leading up to 2030.

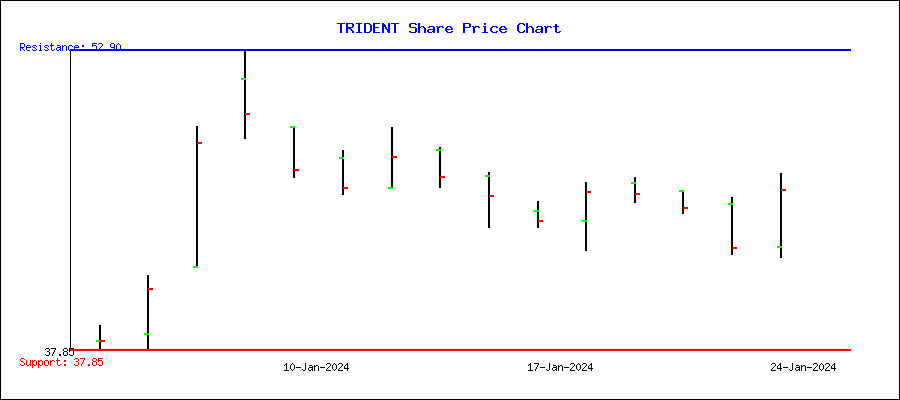

TRIDENT Share Price Target 2024

Throughout 2023, many Indian stocks, including TRIDENT, enjoyed a significant upward trend in their value, commonly called a bull run. Looking ahead to the first quarter of 2024, the overall positive sentiment in the market is anticipated to persist, albeit with some initial consolidation. Based on technical analysis, projections suggest that TRIDENT could see its share price range between ₹43.11 and ₹56.82 in 2024.

| Month | Target |

|---|---|

| April 2024 target for TRIDENT | ₹43.11 |

| May 2024 target for TRIDENT | ₹44.82 |

| June 2024 target for TRIDENT | ₹46.54 |

| July 2024 target for TRIDENT | ₹48.25 |

| August 2024 target for TRIDENT | ₹49.96 |

| September 2024 target for TRIDENT | ₹51.68 |

| October 2024 target for TRIDENT | ₹53.39 |

| November 2024 target for TRIDENT | ₹55.11 |

| December 2024 target for TRIDENT | ₹56.82 |

Summary of TRIDENT Share Price Forecast for 2024

- The projected initial price target for Trident Ltd in 2024 stands at ₹43.11.

- With favourable market conditions, there is potential for the mid-year price target to soar to ₹51.68.

- By the end of 2024, Trident Ltd’s price target could reach ₹56.82, particularly with bullish market trends in consideration.

TRIDENT Share Price Target 2025

The anticipated trajectory for TRIDENT’s share price suggests it will likely reach Rs. 58 by January 2025. Should macro and microeconomic conditions, as well as industry trends, remain favourable, there’s a possibility that Trident Ltd could surpass this mark, aiming for a target price of Rs. 63 by December 2025.

| Month | Target |

|---|---|

| January 2025 target for TRIDENT | ₹58 |

| February 2025 target for TRIDENT | ₹59 |

| March 2025 target for TRIDENT | ₹60 |

| April 2025 target for TRIDENT | ₹58 |

| May 2025 target for TRIDENT | ₹56 |

| June 2025 target for TRIDENT | ₹54 |

| July 2025 target for TRIDENT | ₹56 |

| August 2025 target for TRIDENT | ₹58 |

| September 2025 target for TRIDENT | ₹60 |

| October 2025 target for TRIDENT | ₹61 |

| November 2025 target for TRIDENT | ₹62 |

| December 2025 target for TRIDENT | ₹63 |

Summary of TRIDENT Share Price Forecast for 2025

- Trident Ltd is anticipated to have an initial price target of ₹58 by 2025.

- If market conditions remain favourable, the mid-year projection could surge to ₹54.

- By the close of 2025, Trident Ltd’s price target might soar to ₹63, particularly with bullish market trends.

TRIDENT Share Price Target 2026

As per technical data, The minimum share price target of TRIDENT is expected to reach Rs. 64, and the maximum value that shares of TRIDENT can reach is Rs. 70.

| January 2026 target for TRIDENT | ₹64 |

| February 2026 target for TRIDENT | ₹65 |

| March 2026 target for TRIDENT | ₹66 |

| April 2026 target for TRIDENT | ₹64 |

| May 2026 target for TRIDENT | ₹62 |

| June 2026 target for TRIDENT | ₹60 |

| July 2026 target for TRIDENT | ₹62 |

| August 2026 target for TRIDENT | ₹64 |

| September 2026 target for TRIDENT | ₹67 |

| October 2026 target for TRIDENT | ₹68 |

| November 2026 target for TRIDENT | ₹69 |

| December 2026 target for TRIDENT | ₹70 |

Summary of TRIDENT Share Price Forecast for 2026

- The projected initial price target for Trident Ltd in 2026 stands at ₹64.

- Should market conditions remain favourable, the mid-year price target could potentially soar to ₹60.

- By the end of 2026, Trident Ltd’s price target can reach as high as ₹70, particularly with bullish market trends.

TRIDENT Share Price Target 2027

Utilizing Fibonacci projections, we anticipate Trident Ltd (TRIDENT) to achieve a price target ranging from ₹71 to ₹67 during the initial half of 2027. Subsequently, in the latter half of the year, there is potential for TRIDENT’s share price to surge to a peak value of ₹82.

| Month | Target |

|---|---|

| January 2027 target for TRIDENT | ₹71 |

| February 2027 target for TRIDENT | ₹72 |

| March 2027 target for TRIDENT | ₹73 |

| April 2027 target for TRIDENT | ₹71 |

| May 2027 target for TRIDENT | ₹69 |

| June 2027 target for TRIDENT | ₹67 |

| July 2027 target for TRIDENT | ₹70 |

| August 2027 target for TRIDENT | ₹73 |

| September 2027 target for TRIDENT | ₹76 |

| October 2027 target for TRIDENT | ₹78 |

| November 2027 target for TRIDENT | ₹80 |

| December 2027 target for TRIDENT | ₹82 |

Summary of TRIDENT Share Price Forecast for 2027

- The projected initial price target for Trident Ltd in 2027 stands at ₹71.

- With favourable market conditions, the mid-year price target could potentially reach ₹67.

- By the end of 2027, Trident Ltd’s price target is anticipated to potentially escalate to ₹82, driven by bullish market trends.

TRIDENT Share Price Target 2028

| Month | Target |

|---|---|

| January 2028 target for TRIDENT | ₹84 |

| February 2028 target for TRIDENT | ₹86 |

| March 2028 target for TRIDENT | ₹88 |

| April 2028 target for TRIDENT | ₹85 |

| May 2028 target for TRIDENT | ₹82 |

| June 2028 target for TRIDENT | ₹79 |

| July 2028 target for TRIDENT | ₹82 |

| August 2028 target for TRIDENT | ₹85 |

| September 2028 target for TRIDENT | ₹88 |

| October 2028 target for TRIDENT | ₹90 |

| November 2028 target for TRIDENT | ₹92 |

| December 2028 target for TRIDENT | ₹94 |

Summary of TRIDENT Share Price Forecast for 2028

- In 2028, Trident Ltd is forecasted to have an initial price target of ₹84.

- Should market conditions remain favourable, Trident Ltd can achieve a mid-year price target of ₹79.

- By the conclusion of 2028, Trident Ltd could potentially reach a price target of ₹94, particularly if bullish market trends persist.

TRIDENT Share Price Target 2029

| Month | Target |

|---|---|

| January 2029 target for TRIDENT | ₹96 |

| February 2029 target for TRIDENT | ₹98 |

| March 2029 target for TRIDENT | ₹100 |

| April 2029 target for TRIDENT | ₹97 |

| May 2029 target for TRIDENT | ₹94 |

| June 2029 target for TRIDENT | ₹91 |

| July 2029 target for TRIDENT | ₹95 |

| August 2029 target for TRIDENT | ₹99 |

| September 2029 target for TRIDENT | ₹103 |

| October 2029 target for TRIDENT | ₹105 |

| November 2029 target for TRIDENT | ₹107 |

| December 2029 target for TRIDENT | ₹109 |

Summary of TRIDENT Share Price Forecast for 2029

- The initial price target for Trident Ltd in 2029 is projected to be ₹96.

- With favorable market conditions, the mid-year price target for Trident Ltd could reach ₹91.

- By the end of 2029, the price target for Trident Ltd is expected to reach ₹109, considering bullish market trends potentially.

TRIDENT Share Price Target 2030

| Month | Target |

|---|---|

| January 2030 target for TRIDENT | ₹111 |

| February 2030 target for TRIDENT | ₹113 |

| March 2030 target for TRIDENT | ₹115 |

| April 2030 target for TRIDENT | ₹111 |

| May 2030 target for TRIDENT | ₹107 |

| June 2030 target for TRIDENT | ₹103 |

| July 2030 target for TRIDENT | ₹107 |

| August 2030 target for TRIDENT | ₹111 |

| September 2030 target for TRIDENT | ₹115 |

| October 2030 target for TRIDENT | ₹117 |

| November 2030 target for TRIDENT | ₹119 |

| December 2030 target for TRIDENT | ₹121 |

Summary of TRIDENT Share Price Forecast for 2030

- In 2030, Trident Ltd is forecasted to start with an initial price target of ₹111.

- With favorable market conditions, it could reach ₹103 mid-year.

- Given bullish market trends, by the end of 2030, the target might potentially surge to ₹121.

Key Takeaways from Forecasted Price for TRIDENT from 2024 to 2030

| Year | Initial Target | Mid-Year Target | Year-End Target |

|---|---|---|---|

| 2024 | ₹43.11 | ₹51.68 | ₹56.82 |

| 2025 | ₹58 | ₹54 | ₹63 |

| 2026 | ₹64 | ₹60 | ₹70 |

| 2027 | ₹71 | ₹67 | ₹82 |

| 2028 | ₹84 | ₹79 | ₹94 |

| 2029 | ₹96 | ₹91 | ₹109 |

| 2030 | ₹111 | ₹103 | ₹12 |

- In 2024, Trident Ltd (TRIDENT) is expected to experience strong growth, with an initial target of ₹43.11. However, market volatility might lead to fluctuations mid-year, peaking at ₹53.39.

- For Trident Ltd in 2025, a bullish trend might take the stock to a mid-year target of ₹56, followed by a steady climb to ₹63.

- In 2026, a temporary decline in early months for Trident Ltd is possible, with a recovery expected by mid-year, aiming for ₹62.

- Anticipating mixed trends for Trident Ltd in 2027, with rapid upward and downward movements, yet maintaining an upward trajectory towards ₹82.

- For 2028 and 2029, Trident Ltd is expected to show strong and steady growth, potentially breaking past previous highs and setting new records.

- By 2030, the cumulative impact of market dynamics could lead Trident Ltd to a substantial year-end target, surpassing previous expectations.

Trident Ltd Share Price Overview: Today’s Market Update

As of today, Trident Ltd’s share price in the stock market reflects ongoing investor sentiment and market dynamics. Let’s delve into the key aspects:

1. Stock Market Performance Today:

Trident Ltd’s share price in the stock market today is influenced by factors such as company news, industry trends, and broader market conditions. Investors closely monitor these fluctuations for investment opportunities.

2. Mutual Funds Chart Analysis:

Examining Trident Ltd’s share price through mutual funds charts provides insights into fund managers’ perspectives and investment patterns. It helps investors gauge institutional sentiment towards the stock.

3. Share Price Target 2025 and Beyond:

Analysts and market experts project Trident Ltd’s share price targets for 2025 and beyond, considering factors like company performance, industry growth, and market trends. These targets guide investors in making informed decisions.

4. Registered Office Address:

Trident Ltd’s registered office address is a key detail for investors, providing information about the company’s headquarters and operational base. It reflects stability and transparency in corporate governance.

5. Latest Updates on Trident Ltd Share Price:

Stay updated with Trident Ltd’s share price trends today to understand market sentiment and potential investment opportunities. Real-time data aids in making timely investment decisions.

6. Q4 Results Announcement:

Today, Trident Ltd’s share price may react to the company’s Q4 results. These reports reveal investors keenly analyze financial performance, revenue growth, profitability, and future outlook.

7. Long-Term Share Price Targets:

Looking ahead, share price targets for 2040 and 2050 provide a glimpse into Trident Ltd’s long-term growth prospects. These targets reflect analysts’ expectations based on fundamental and strategic factors.

8. Share Price Screener Analysis:

Using share price screeners helps investors filter and analyze Trident Ltd’s stock performance based on various criteria such as market cap, price-to-earnings ratio, and dividend yield. It aids in identifying potential investment opportunities.

In conclusion, staying informed about Trident Ltd’s share price movements, target projections, and market updates empowers investors to make well-informed decisions aligned with their investment goals and risk tolerance.

FAQ’s

Is Trident a good stock to buy?

Trident’s trailing twelve months (TTM) P/E ratio is 42.70, lower than the sector’s 51.24. One analyst has begun coverage on Trident with a strong buy rating, while no analysts rate it as a buy or sell.

What is the future of Trident Ltd?

Trident on NSE’s maximum share price target in 2026 is Rs 80. Looking ahead, the predicted maximum share price for Trident on NSE in 2030 is Rs 168.

Is Trident a debt-free company?

Trident’s debt stood at ₹16.6 billion by September 2023, rising from ₹13.7 billion the previous year. Despite this, the company held ₹4.02 billion in cash, resulting in a net debt of ₹12.6 billion.

Conclusion

We have presented the TRIDENT share price targets for 2024, 2025, 2026, and 2030 based on the most recent trading data and algorithms. These targets serve as potential support and resistance levels for the coming years.

It’s essential to note that while these price targets are based on technical analysis, other market conditions and news could also impact the stock’s performance. Therefore, these hypothetical targets should be guidelines, not financial advice. Always perform your due diligence before making any investment.